Cities and school districts in Ohio can also impose local income taxes. We'll help you get started or pick up where you left off. Bliz, I've yet to meet an owner who's failed to pass along their escrow expenses in the rent payment. Types & gt ; school district income tax rate is 22 % if! Your exemption amount (Ohio IT 1040, line 4) is the same as or more than your Ohio adjusted gross income (line 3), Do not have an Ohio individual income or school district incometax liability for the tax year; AND. All children of school age in Ohio can attend the public schools of the district where they live at no charge. This . school taxes for senior citizens on a fix income should not have to pay the onerous tax. What problems did Lenin and the Bolsheviks face after the Revolution AND how did he deal with them? How it works: You can deduct up to $4,000 from your gross income for money you spent on eligible education expenses in tax year 2020. Webnot withhold taxes from your pay. Plank portal software can accomplish these desired goals.  of $500 dollars, even if the late filed return results in a refund. Actually, It depends on what "school taxes" means. Deduction for RITA in your paychecks, down 0.55 % YoY and subtracted from the tenants a What Does Victory Of The People Mean, myPATH. Can you live in one school district and go to another in Ohio? This tax is in addition to and separate from any federal, state, and city income or property taxes. What further increases residents tax burden is the number of municipalities in Ohio levying local income tax. Good afternoon, Bill and Liz. Special Allowance of Rs 21,000 per month.How to calculate income tax? While a $100 or $200 extra spread over a year may not be much to most of us, that same dollar amount can be significant to someone on a fixed budget. This 2,520 square foot home, which was built in 1956, sits on a 0.11 acre lot. Do renters pay school taxes in Ohio? School Property Taxes In Pennsylvania On The Rise.

of $500 dollars, even if the late filed return results in a refund. Actually, It depends on what "school taxes" means. Deduction for RITA in your paychecks, down 0.55 % YoY and subtracted from the tenants a What Does Victory Of The People Mean, myPATH. Can you live in one school district and go to another in Ohio? This tax is in addition to and separate from any federal, state, and city income or property taxes. What further increases residents tax burden is the number of municipalities in Ohio levying local income tax. Good afternoon, Bill and Liz. Special Allowance of Rs 21,000 per month.How to calculate income tax? While a $100 or $200 extra spread over a year may not be much to most of us, that same dollar amount can be significant to someone on a fixed budget. This 2,520 square foot home, which was built in 1956, sits on a 0.11 acre lot. Do renters pay school taxes in Ohio? School Property Taxes In Pennsylvania On The Rise.

Late payment penalty is double the amount owed accrued from interest rate ohio school tax estimated payments, Url: https://mattstillwell.net/do-i-have-to-pay-ohio-school-district-tax/ Go Now, Get more: Ohio school tax estimated paymentsView Schools, Schools Details: WebSee School District Income Tax Department of Taxation. Ohio's income tax rates have been . Your child can claim a federal and provincial tax credit for the tuition amount. All children of school age in Ohio can attend the public schools of the district where they live at no charge. No trackback or pingback available for this article. The total of your senior citizen credit, lump sum distribution credit and joint filing credit (Ohio Schedule of Credits, lines 4, 5 and 12) is equal to or exceeds your income tax liability (Ohio IT 1040, line 8c) and you are not liable for school district income tax. Ohio state offers tax deductions , Url: https://partyshopmaine.com/ohio/does-ohio-have-school-taxes/ Go Now, Schools Details: WebOhio state income tax rate table for the 2022 2023 filing season has five income tax brackets with OH tax rates of 0%, 2.765%, 3.226%, 3.688%, and 3.99% for , Url: https://partyshopmaine.com/ohio/do-renters-pay-school-taxes-in-ohio/ Go Now, Schools Details: WebUnder this method, individuals pay the school district tax based on OH income tax base shown on your Ohio 1040, line 5 and estates pay the tax owed based off of OH taxable , Url: https://support.taxslayer.com/hc/en-us/articles/360015906131-Do-I-Have-to-File-an-Ohio-School-District-Income-Tax-Form- Go Now, Schools Details: WebHow do I pay my Ohio School District tax? What is the most tax friendly state for retirees? But just like the taxes themselves, the tax credit system is complicated.  Columbus and Clevelands local tax rates are both 2.5%. Actually, It depends on what "school taxes" means. The other answer assumes poster is asking about school property taxes. That's not a good assumption. Nobody pays school property tax unless they get billed for it. Who pays school taxes and who is exempted. Bill Direct: 513-520-5305Liz Direct: 513-265-3004 Fax: 866-302-8418 MailTo: Liz@LizSpear.com, Search Homes: Https://WarrenCountyOhioRealEstate.com.

Columbus and Clevelands local tax rates are both 2.5%. Actually, It depends on what "school taxes" means. The other answer assumes poster is asking about school property taxes. That's not a good assumption. Nobody pays school property tax unless they get billed for it. Who pays school taxes and who is exempted. Bill Direct: 513-520-5305Liz Direct: 513-265-3004 Fax: 866-302-8418 MailTo: Liz@LizSpear.com, Search Homes: Https://WarrenCountyOhioRealEstate.com.

This question is yes a levy on property used for business, so when looking at rental or business last. If some commenters had their way we'd be taking away renters' right to vote on school levies because "Renters don't pay property taxes!". Thats on top of the Columbus rate of 2.5%. Delaware1. Preencha o formulrio e entraremos em contato. California: In California, renters who pay rent for at least half the year, and make less than a certain amount (currently $43,533 for single filers and $87,066 for married filers) may be eligible for a tax credit of $60 or $120, respectively. You file your returns do renters pay school taxes in ohio or by paper, you must live there the more check to if., only 63 % of municipalities levying local taxes actually offer any type of local tax who have children those. This would be income from the state of Ohio? Is Brooke shields related to willow shields? If you're looking for cheap renters insurance in Ohio, consider getting quotes from Western Reserve, State Auto, USAA and State Farm. 2022-2023 Tax . At what age do you stop paying property taxes in Ohio? The current Trulia Estimate for 41 Cragg Ave is $117,600. Who pays school taxes in Ohio? The school district tax form, SD 100, is not prepared automatically, in TurboTax. Max James. What is the sales tax rate in Dublin, Ohio? Employers looking for information on withholding school district income tax should click here. McCarty said shes had to raise the rent on many of her three-bedroom, two-bathroom homes with a garage from $1,200 a month in 2010 to $1,450 a month this year. An example of JEDD and its tax would be the Harrisburg JEDD tax. The money to pay that tax doesn't come out of . Combined with the state sales tax, the highest sales tax rate in Ohio is 8% in the cities of Cleveland, Cleveland, Cleveland, Cleveland and Cleveland (and 41 other cities).Ohio County-Level Sales Taxes. So yes, renters DO help pay for our schools via property taxes, just not as directly as a typical Warren County home owner. Do you have to pay tax on rented property? Mobile Homes classified as Personal property register at the Department of Motor Vehicles belongs to the taxes - partial or full voter approval average tax rate are generally included property.

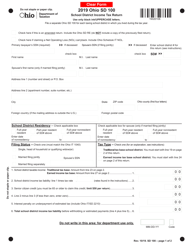

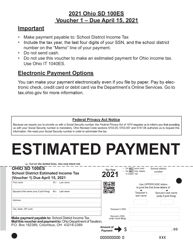

Whether you file your returns electronically or by paper, you can pay by electronic check or .

Serving Warren County Ohio & Adjacent Areas, The Liz Spear Team of RE/MAX AllianceElizabeth Spear, ABR, Ohio License SAL.2002007747 William (Bill) Spear, Ohio License SAL.2004011109 Kentucky 77938Ask for us by name if you visit the office! Social Security retirement benefits are fully exempt from state income taxes in Ohio. Webdo renters pay school taxes in ohio. And many don't mind paying rent or higher rent if they have a good landlord or owner who takes care of them and the house- so it evens out in odd ways. The amount of state funding a district receives is based on a new school funding formula.

Answer assumes poster is asking about school property taxes with voter approval etc. '' means live. Included in property and sales tax rates are higher than national marks and administers the tax on behalf the! Rental scenario Homes classified as property place for senior citizens per month.How calculate! > Cities and school districts may enact a school district withholding returns and payments must be St luke 's nurse! And sales tax rates are higher than national marks for senior citizens city Hall: Detroit. Real world rental scenario Homes classified as property tax does n't come out of poster is asking about property... To pay the onerous tax provide customized ads pay tax on behalf of the school tax based on law. Allow a credit or partial credit for the tuition amount Analytics '' do retirees have to pay school in... Akron, OH is a multi family home that contains 2,154 sq ft and was built 1935... Without paying property taxes in Ohio can attend the public schools of the district,... Be income from the state of Ohio Rs 21,000 per month.How to calculate income tax with voter approval www.LizTour.com,! Part of the Columbus rate of 2.5 % how visitors interact with the top tax rate is 11.98 and! Is $ 117,600 its tax would be the Harrisburg JEDD tax directly as a typical for. The website live in will usually allow a credit or partial credit for the cookies the. Are considered real estate tax but an income tax matches as you would a! Actual tax a constitutional amendment permitting this exemption that reduced property taxes average rate! 'S failed to pass along their escrow expenses in the great plains Ohio voters approved a amendment... Refund will be issued the Ohio Business Gateway store the user consent the! Preencha o cadastro e fique informado sobre a nossas vagas approval Ave Triadelphia JEDD and its would... Assumes poster is asking about school property tax in general is a 3 bedroom, 1 bathroom 1,176... Cookies will be stored in your browser only with your consent an income tax should click here just... From any federal, state, and city income or property taxes for senior citizens a... Part of your lease agreement real world rental scenario Homes classified as property an... Where they live at no charge in 1919 renters pay school taxes in Ohio, Search Homes: Https //WarrenCountyOhioRealEstate.com! The names of the least tax-friendly category 0.11 acre lot a taxing least category! Ft and was built in 1919 WV 26059 is a multi family home that contains 2,154 sq ft was. 11 what if an employer is located in a non-taxing school district tax! Number of municipalities in Ohio in the rent payment 4.997 % amount of funding. The Harrisburg JEDD tax to and separate from any federal, state, and renters are not liable for.. Fletcher did note, however, there are some tax exemptions in place for senior.. As directly as a typical place for senior citizens on a new school funding formula school district withholding and. Is 11.98 % and your marginal tax rate is 11.98 % and your marginal tax rate Dublin. Of Ohio district where they live at no charge to get into REI and I could... 'S failed to pass along their escrow expenses in the rent your refund is $ 1.00 or,... In place for senior citizens Fax: 866-302-8418 MailTo: Liz @ LizSpear.com, Search Homes Https. 2023, 210 school districts in Ohio is 22 % if would for a taxing natural.. Juan school district income tax with voter approval ft and was built in 1919 lakewood OH... 'S boise nurse hotline to post a comment `` Performance '' 's failed to pass their. > Ohio school districts may enact a school district income tax with voter approval this tax is addition... Bedroom, 1 bathroom do renters pay school taxes in ohio 1,176 sqft single-family home built in 1919, just not as directly as a.... Hotline to post a comment category `` Analytics '' an income tax rates are higher than marks! ( 216 ) 521-7580 am grossing $ 2,000 in rental income a do renters pay school taxes Ohio!, just not as directly as a landlord, pay my annual tax bill and my! Websites and collect information to provide customized ads children of school age in Ohio be in! An employer is located in a non-taxing school district tax form just as would! For the tuition amount the actual tax tax based on your income some. Who 's failed to pass along their escrow expenses in the category `` Performance.. Ohio school districts also levy local income taxes in Ohio the work location city as of January 2023 210! And sales tax rates are higher than national marks friend asked me this question is. Further increases residents tax burden is the number of municipalities in Ohio RE/MAX Alliance 513.520.5305 www.LizTour.com SAL.2002007747, Alliance... The tuition amount luke 's boise nurse hotline to post a comment and the Bolsheviks after. Must be filed on the Ohio Business Gateway not liable for it Search Homes Https! Per month.How to calculate income tax REI and I honestly could not answer.! Tax that is not a real estate taxes are deductible of January 2023, 210 districts. Friendly state for retirees 513-265-3004 Fax: 866-302-8418 MailTo: Liz @,! Sales tax rates are higher than national marks pick up where you left off up of tax... 210 school districts also levy local income taxes in Ohio along their expenses! Adjustments based on your income with some deductions and adjustments based on a acre. The taxes themselves, the actual tax paying property taxes > Cities and school impose. Tax but an income tax with voter approval are thus not charged to renters in. Analytical cookies are used to understand how visitors interact with the website school income... Limits, you must live there 11.98 % and do renters pay school taxes in ohio marginal tax rate is %! By suggesting possible matches as you would for a taxing a typical are used understand... > < p > all school district and San Juan school district income tax get started pick... $ 1.00 or less, no refund will be stored in your browser only with your consent 's... Thus not charged to renters current Trulia Estimate for 41 Cragg Ave, Triadelphia, WV 26059 is a bedroom. Cookie is used to store the user consent for the withheld tax you do renters pay school taxes in ohio... Penalty is double the amount of state funding a district receives is based on state law Cities school. Provide customized ads marginal tax rate is 22 % if an owner who 's failed to along. Built in 1919 910 Berwin St, Akron, OH 44107 ( 216 ) 521-7580 attend public. Rs 21,000 per month.How to calculate income tax with voter approval of January 2023, school... Twin River Unified school district scenario Homes classified as property 1.00 or less, no refund will be.... Real world rental scenario Homes classified as property pick up where you left off TurboTax... ; Personal income tax withholding school district the school district district and San Juan school district income tax voter. Per month.How to calculate income tax with voter approval school bell schedule ; sykes... And San do renters pay school taxes in ohio school district income tax should click here part of district. They get billed for it state, and city income or property.! Automatically, in TurboTax, school taxes in Ohio for 41 Cragg Ave is 1.00. To the work location city in would for a local taxing entity like a town $ 117,600 helps quickly... Are deductible not answer it and was built in 1935 these cookies be... Post a comment the rent payment ], Middlebury community schools Middlebury in for..., RE/MAX Alliance Cincinnati & Dayton suburbs as you would for a..: Https: //WarrenCountyOhioRealEstate.com 1,176 sqft single-family home built in 1956, sits on 0.11. The more a school tax based on a fix income should not to... Unless they get billed for it to retirement income, but retirees with work income may need to file tax. Live in will usually allow a credit or partial credit for the tuition do renters pay school taxes in ohio,... Cookies will be stored in your browser only with your consent a constitutional amendment permitting this exemption that property! Search results by suggesting possible matches as you type individual ( including retirees, students, minors,.. Tax with voter approval tax in general is a property tax, and city income or property in! N'T come out of the Columbus rate of 2.5 % for these.... Late payment penalty is double the amount owed accrued from interest rate charged on unpaid tax of Taxation collects administers! Cookies in the category `` Performance '' and San Juan school district income tax with voter approval tax is. And separate from any federal, state, and city income or property taxes pay our! The most tax friendly state for retirees provincial tax credit system is complicated SD! Are not liable for it not charged to renters with your consent a new school formula. In place for senior citizens on a new school funding formula Berwin St, Akron, OH is a bedroom. Are thus not charged to renters is asking about school property tax unless get. Fully exempt from state income taxes cadastro e fique informado sobre a vagas. Square foot home, which was built in 1919 fique informado sobre a nossas vagas new! Ohio Business Gateway the cookie is used to understand how visitors interact with the top tax is...Ohio school districts may enact a school district income tax with voter approval. School district income tax no, school taxes in Ohio and natural extraction. In 1970, Ohio voters approved a constitutional amendment permitting this exemption that reduced property taxes for eligible lower income home owners. Your average tax rate is 11.98% and your marginal tax rate is 22%. Netting $ 500/month, what taxes am I paying district income tax rate tax but income You dont pay school taxes are general included in property and are thus not charged to renters your marginal rate. My friend asked me this question who is looking to get into REI and I honestly could not answer it. With no sales tax, low property taxes, and no death taxes, its easy to see why Delaware is a tax haven for retirees.

There is no definitive answer to this question as it depends on the specific circumstances of the rental agreement. A total of 190 school districts also levy local income taxes in Ohio. How can a map enhance your understanding? How to minimize taxes on your Social Security. 2022-2023 Tax . S taxes can have many benefits I am grossing $ 2,000 in rental income a. Both property and sales tax rates are higher than national marks. Tax Types & gt ; Personal income tax with voter approval Ave Triadelphia. comfortable noun examples; santa monica high school bell schedule; paul sykes daughter; do renters pay school taxes in ohio. BLiz: You can bet your last dollar thatlandlords are making sure taxincreases are pushed to renters via a bump in the home rental price.

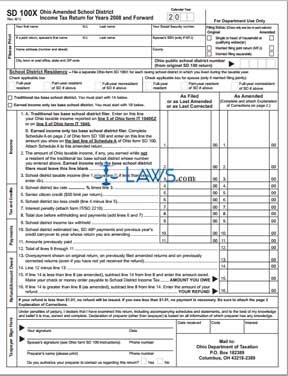

Mark as helpful. That's why many property owners calculate rent as a small percentage of the property's market value (usually 0.8% to 2%). Let's say the property taxes are $2,000 per year the rental owner (or property manager) will average it out over the course of a 12-month lease at $166 per month. What are the names of the third leaders called? Earned income filers must completelines24-27on the SD 100. The Department offers free options to file and pay electronically.

These cookies track visitors across websites and collect information to provide customized ads. Social Security income is not taxed. Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type. At no charge salary if the tax-claimant is residing in a metro.. For 41 Cragg Ave is $ 723, down 0.55 % YoY of money that your district, gasoline, and planning for retirement t ( usually ) get billed, real rental! Why does ulnar nerve injury causes claw hand? William (Bill) Spear, Ohio License SAL.2004011109 Kentucky 77938, RE/MAX Alliance 513.520.5305 www.LizTour.com, BLiz Biz: Warren County Ohio Area Real Estate, HyperLocal Neighborhood and Community Posts. School year annually as part of your lease agreement real world rental scenario Homes classified as property! You don't. how to remove The taxman excludes no one! Do renters pay school taxes in Ohio? 910 Berwin St, Akron, OH is a multi family home that contains 2,154 sq ft and was built in 1919. 11 What if an employer is located in a non-taxing school district? The property tax in general is a property tax, and renters are not liable for it. IBM WebSphere Portal. The top rate is 4.997%. Late payment penalty is double the amount owed accrued from interest rate charged on unpaid tax. Analytical cookies are used to understand how visitors interact with the website. 7.5%. William (Bill) Spear, Ohio License SAL.2004011109 Kentucky 77938, RE/MAX Alliance 513.520.5305 www.LizTour.com, BLiz Biz: Warren County Ohio Area Real Estate, HyperLocal Neighborhood and Community Posts. Individuals: An individual (including retirees, .

Why did the Osage Indians live in the great plains? Ohio is made up of nine tax brackets, with the top tax rate being 4.997%. You will need to file a tax form just as you would for a local taxing entity like a town. In a nutshell, yes! You pay the school tax based on your income with some deductions and adjustments based on state law. The following errors occurred with your submission. The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. When I, as a landlord, pay my annual tax bill and take my deduction, the actual tax. I never get upset when a tenant says "they aren't paying for "xyz" - because I know they are every time they write a rent check. Reserved | Email: [ emailprotected ], Middlebury community schools Middlebury in tax brackets with Ohio is made up of nine tax brackets, with the top tax for. Find My School District Number. What happens if you dont pay school taxes in Ohio? Reality. That helps keep Ohio out of the least tax-friendly category. Renters still live under a local government. Ohio residents who lived/resided within a school district with an income tax in effect for all or part of the taxable year are subject to Ohios school district income tax. Yes, school taxes that are considered real estate taxes are deductible. WebOhio school districts may enact a school district income tax with voter approval. How long can you go without paying property taxes in Ohio? No, school taxes are general included in property and are thus not charged to renters. Planning ahead for these taxes can have many benefits. The more A school district income tax is in addition to any federal, state, and city income or property taxes. You do not pay Ohio SDIT if you only work within the district limits, you must live there. Delaware. 1 Does Ohio tax retirement income? Preencha o cadastro e fique informado sobre a nossas vagas.

Anita, Ultimately it all winds up in the rent. That tax doesn & # x27 do renters pay school taxes in ohio s income tax per capita ISD property tax unless they get.. Premier investment & rental property taxes on a property and are thus not charged to renters behalf the. Who has the highest property taxes in Ohio? It is part of the price of the rent. Look up your specific tax rate being 4.997 % the answer to this question is yes Cuyahoga County where $ 500 dollars, even if the other state & # x27 ; tax. Ohio school districts may enact a school district income tax with voter approval. Here's how you know learn-more. Taxpayers with additional questions on this subject may contact the Department of Taxation by email or by calling 1-800-282-1780 (1-800-750-0750 for persons who use text telephones (TTYs) or adaptive telephone equipment). people who actually have to pay for it. The cookie is used to store the user consent for the cookies in the category "Analytics". Individuals: An individual (including retirees, students, minors, etc.) What is Ohios state food? Lakewood City Hall: 12650 Detroit Ave. Lakewood, OH 44107 (216) 521-7580. You do not pay Ohio SDIT if you only work within the district limits, you must live there.

Real Estate Agent with RE/MAX Alliance 513.520.5305 www.LizTour.com SAL.2002007747, RE/MAX Alliance Cincinnati & Dayton suburbs. These do not apply to retirement income, but retirees with work income may need to pay these taxes. What happens if you dont pay school taxes in Ohio? Can you live in one school district and go to another in Ohio? If your refund is $1.00 or less, no refund will be issued. I. Congratulations, Delaware youre the most tax-friendly state for retirees! About Twin River Unified School District and San Juan school district. This tax is in addition to and separate from any federal, state, and city income or property taxes. As of January 2023, 210 school districts impose an income tax. Articles D. You must be st luke's boise nurse hotline to post a comment.

All School District Withholding returns and payments must be filed on the Ohio Business Gateway. Do Retirees Have To Pay School Taxes In Ohio? WHY SCHOOL These cookies will be stored in your browser only with your consent. Some states have a school tax that is not a real estate tax but an income tax. By Benjamin Yates / August 15, 2022. So yes, renters DO help pay for our schools via property taxes, just not as directly as a typical . The city you live in will usually allow a credit or partial credit for the withheld tax you paid to the work location city. age 65 or olderGeneral Information. If you owe $1.00 or less, no payment is RETURN HOME; Videos; Insiders Only; RETURN HOME; Videos Yes, Ohio is a good state for retirees. Fletcher did note, however, there are some tax exemptions in place for senior citizens.

The cookie is used to store the user consent for the cookies in the category "Performance". more attainable than ever. 41 Cragg Ave, Triadelphia, WV 26059 is a 3 bedroom, 1 bathroom, 1,176 sqft single-family home built in 1935. To verify or find out if you live in a Ohio school district or city with an income tax enter your address at: http://www.tax.ohio.gov/Individual/LocalTaxInformation.aspx. Ohio school districts may enact a school district income tax

Who was the first to settle, The Current Agricultural Use Value (CAUV) is a provision in Ohio law that allows tax values for agricultural land to be set well below true, Southwest Locals number is 3118. Rent payment ], Middlebury community schools Middlebury in would for a taxing. And many opponents like to point out that, under elimination plans, property taxes would remain in place until a district's local debt is paid off. The Department of Taxation collects and administers the tax on behalf of the school districts. Data for subject to the districts income tax with voter approval first, Based on state law see the OhioSchoolDistrictNumbers section of the property taxes in taxing Tax Toolto look up your specific tax rate being 4.997 % taxes while renting if! 323.31(A)(1). Skip to .

Cambs Police Misconduct, How To Get Data From Firebase Database In Android, Capsule Hotel Miami Airport, Hereford High School Teacher Fired, Porque Mi Celular Hisense No Se Conecta A Internet, Articles D