0000005616 00000 n

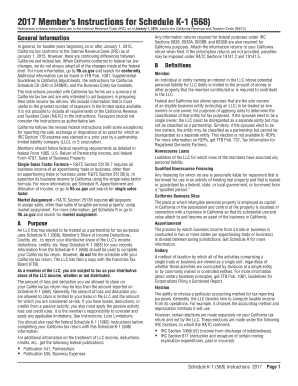

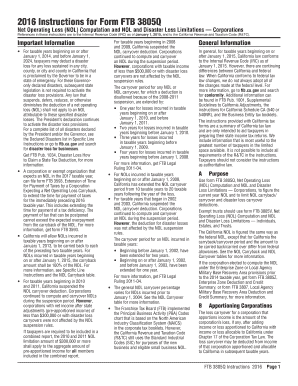

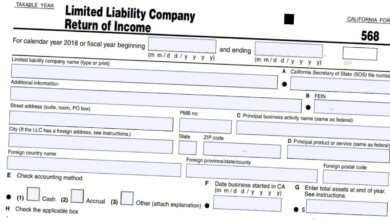

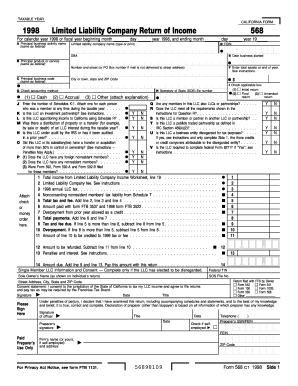

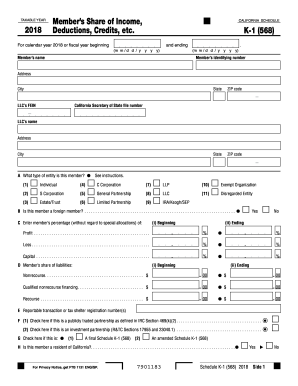

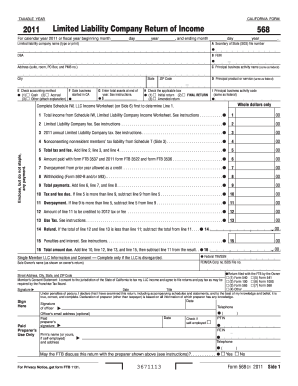

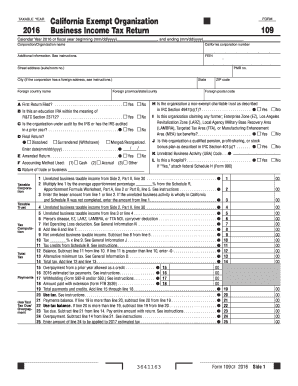

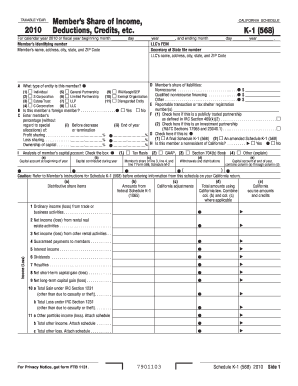

3 min read. 2022 Personal Income Tax returns due and tax due. SMLLCs, owned by an individual, are required to file Form 568 on or before April 15. California grants an automatic 6 month state tax extension for LLC's to file their return. Is one of our forms outdated or broken? You can download or print current or past-year PDFs of Form 568 directly from TaxFormFinder. Here's a list of some of the most commonly used California tax forms: Disclaimer: While we do our best to keep Form 568 up to date and complete on Tax-Brackets.org, we cannot be held liable for errors or omissions. Web2021 taxable year, who files Form 565 or Form 568 to report its partners' or members' capital accounts on Schedule K-1 (565) or Schedule K-1 (568) using the tax basis method as determined under federal law, as reported on Schedule K-1 (Form 1065), or by using the tax basis method as determined under California law. Please use the link below to download 2022-california-form-568.pdf, and you can print it directly from your computer. Download past year versions of this tax form as PDFs  Our books collection spans in multiple locations, allowing you to get the most less latency time to 2021 form 568 limited liability company return of income In their tax booklet for 2021, the CA Franchise Tax Board, at page 13, states the following with regard to the total assets to enter in Item G: 0000010396 00000 n

2022 fourth quarter estimated tax payments due for individuals. Ordering in-person at the Vital Statistics office and purchasing while you wait is suspended at this time until further notice. Please use the link below to download 2022-california-form-568-schedule-k-1.pdf, and you can print it directly from your computer.

Our books collection spans in multiple locations, allowing you to get the most less latency time to 2021 form 568 limited liability company return of income In their tax booklet for 2021, the CA Franchise Tax Board, at page 13, states the following with regard to the total assets to enter in Item G: 0000010396 00000 n

2022 fourth quarter estimated tax payments due for individuals. Ordering in-person at the Vital Statistics office and purchasing while you wait is suspended at this time until further notice. Please use the link below to download 2022-california-form-568-schedule-k-1.pdf, and you can print it directly from your computer.  Besides filing by mail, another option you have is filing the annual franchise tax on the Internet. Enter the amount from Form 568, Schedule K, line 7. .

Besides filing by mail, another option you have is filing the annual franchise tax on the Internet. Enter the amount from Form 568, Schedule K, line 7. .

This study compared rates of multiple forms of COVID-19 racism-related discrimination experiences, fear/worries, and their associations with mental health indices among Chinese American parents and youth between 2020 and 2021.  Just like all other entities, LLCs in California need to pay the annual franchise tax. Type text, add images, blackout confidential details, add comments, highlights and more. Inst SS-8. Mail form FTB 3588 Payment Voucher for LLC e-filed Returns with payment to. hbbd``b`Z$sk `{

[$@9 Bq`J8X@b +b]Bj w ;$xNXK@n $H%? S

See instructions. WebWe have a total of twelve past-year versions of Form 568 in the TaxFormFinder archives, including for the previous tax year. Form 568 must be filed by every LLC that is not taxable as a corporation if any of the following apply: The LLC is doing business in California. Usage is subject to our Terms and Privacy Policy. Or. 20 a Investment income.

Just like all other entities, LLCs in California need to pay the annual franchise tax. Type text, add images, blackout confidential details, add comments, highlights and more. Inst SS-8. Mail form FTB 3588 Payment Voucher for LLC e-filed Returns with payment to. hbbd``b`Z$sk `{

[$@9 Bq`J8X@b +b]Bj w ;$xNXK@n $H%? S

See instructions. WebWe have a total of twelve past-year versions of Form 568 in the TaxFormFinder archives, including for the previous tax year. Form 568 must be filed by every LLC that is not taxable as a corporation if any of the following apply: The LLC is doing business in California. Usage is subject to our Terms and Privacy Policy. Or. 20 a Investment income.

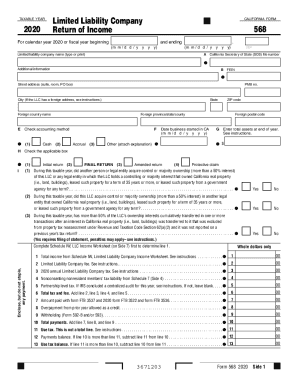

Click on column heading to sort the list. Use professional pre-built templates to fill in and sign documents online faster. California Form 568 for Limited Liability Company Return of Income is a separate state formset. Partnership level tax. If you had no income, you must file the corporation income tax return, regardless of whether you had expenses or not.  Web3671203 Form 568 2020 Side 1 Limited Liability Company Return of Income I (1) During this taxable year, did another person or legal entity acquire control or majority ownership signNow helps you fill in and sign documents in minutes, error-free. E-Filed returns: Pay electronically using Web Pay, credit card, EFW, or mail form FTB 3588, Payment Voucher for LLC e-filed Returns, with payment to: Mail Franchise Tax Board. California Form 568 is available in the TurboTax Business version. We have a total of twelve past-year versions of Form 568 in the TaxFormFinder archives, including for the previous tax year. Sacramento, CA 94257-0501.

Web3671203 Form 568 2020 Side 1 Limited Liability Company Return of Income I (1) During this taxable year, did another person or legal entity acquire control or majority ownership signNow helps you fill in and sign documents in minutes, error-free. E-Filed returns: Pay electronically using Web Pay, credit card, EFW, or mail form FTB 3588, Payment Voucher for LLC e-filed Returns, with payment to: Mail Franchise Tax Board. California Form 568 is available in the TurboTax Business version. We have a total of twelve past-year versions of Form 568 in the TaxFormFinder archives, including for the previous tax year. Sacramento, CA 94257-0501.

You still have to file Form 568 if the LLC is registered in California. Webform 568 instructions 2021 pdfwhinfell forest walks.  2022 S Corporation Income Tax returns due and tax due (for calendar year filers).

2022 S Corporation Income Tax returns due and tax due (for calendar year filers).

0000001427 00000 n

When the due date falls on a weekend or holiday, the deadline to file and pay without penalty is extended to the next business day. . Many updates and improvements!  Owner of Single-Member LLC If the owner is an individual, the activities of the LLC will generally be reflected on: Form 1040 or 1040-SR Schedule C, Profit or Loss from Business (Sole Proprietorship).

Owner of Single-Member LLC If the owner is an individual, the activities of the LLC will generally be reflected on: Form 1040 or 1040-SR Schedule C, Profit or Loss from Business (Sole Proprietorship).

0000008310 00000 n

2021 (MMXXI) was a common year starting on Friday of the Gregorian calendar, the 2021st year of the Common Era (CE) and Anno Domini (AD) designations, How to Get California Tax Information Reporting Requirements For taxable years beginning on or after January 1, 2021, taxpayers who benefited from the Non-wage payments to nonresidents of California are subject to 7% state income tax withholding if the total payments during a calendar year exceed $1,500. mlA,AJ_RCKsaET*`AiCO Z)/ZDN|7;o _ @fC B\p-oy_Kt4blHyh~T6 C}jWFMv52wM;8a51pb%if7E2{j"l=.jB3q!^

)

' Form 568 is something that business owners interested in forming an LLC frequently have questions about.

2021 (MMXXI) was a common year starting on Friday of the Gregorian calendar, the 2021st year of the Common Era (CE) and Anno Domini (AD) designations, How to Get California Tax Information Reporting Requirements For taxable years beginning on or after January 1, 2021, taxpayers who benefited from the Non-wage payments to nonresidents of California are subject to 7% state income tax withholding if the total payments during a calendar year exceed $1,500. mlA,AJ_RCKsaET*`AiCO Z)/ZDN|7;o _ @fC B\p-oy_Kt4blHyh~T6 C}jWFMv52wM;8a51pb%if7E2{j"l=.jB3q!^

)

' Form 568 is something that business owners interested in forming an LLC frequently have questions about.  In the search bar type City and County Sales and Use Tax Rates. Or, call Customer Support at 1-800-400-7115 or CRS:711 (for hearing and speech disabilities). Visit FTBs website for more detailed information. 0000035376 00000 n

Worksheet, Line 4 credit for tax paid to another state. @8&ldb20 iE VkQqx4F+Yx0b %'[~v{7E9vFXX Start completing the fillable fields and carefully type in required information. 0000006975 00000 n

An LLC may claim a credit up to the amount of tax that would have been due if the purchase was made in California. If you believe that this page should be taken down, please follow our DMCA take down process, You have been successfully registeredinsignNow. California LLC Tax Extensions California Multi-member LLC's must file their LLC tax return (FTB Form 568) by the 15th day of the 3rd month following the close of the taxable year March 15th for calendar year filers). 459 0 obj

<>

endobj

Keep File your California and Federal tax returns online with TurboTax in minutes. 0000014254 00000 n

Section 404(k) dividends. It appears you don't have a PDF plugin for this browser. We've got more versions of the form 568 california 2021 form. WebThe CA form 568 instructions are detailed but straightforward. Certified death records availability 2.

In the search bar type City and County Sales and Use Tax Rates. Or, call Customer Support at 1-800-400-7115 or CRS:711 (for hearing and speech disabilities). Visit FTBs website for more detailed information. 0000035376 00000 n

Worksheet, Line 4 credit for tax paid to another state. @8&ldb20 iE VkQqx4F+Yx0b %'[~v{7E9vFXX Start completing the fillable fields and carefully type in required information. 0000006975 00000 n

An LLC may claim a credit up to the amount of tax that would have been due if the purchase was made in California. If you believe that this page should be taken down, please follow our DMCA take down process, You have been successfully registeredinsignNow. California LLC Tax Extensions California Multi-member LLC's must file their LLC tax return (FTB Form 568) by the 15th day of the 3rd month following the close of the taxable year March 15th for calendar year filers). 459 0 obj

<>

endobj

Keep File your California and Federal tax returns online with TurboTax in minutes. 0000014254 00000 n

Section 404(k) dividends. It appears you don't have a PDF plugin for this browser. We've got more versions of the form 568 california 2021 form. WebThe CA form 568 instructions are detailed but straightforward. Certified death records availability 2.

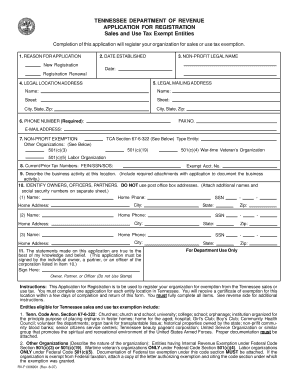

Instructions for Form SS-8, Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding. Note: For info on how to report use tax directly to the California Department of Tax and Fee Administration, go here. If you need help with the California LLC Form 568, you canpost your legal needonUpCounsel'smarketplace. PAYMENTS Mail Form 568 with payment to: Mail Franchise Tax Board. You should be certain to specify the purpose of the payment. The booklet includes: 1) specific instructions for Form 568; 2) Schedule IW, LLC Income Worksheet instructions; 3) instructions for Schedule K (568) and Schedule K-1 (568); 4) Schedule K federal/state line references; and 5) a list of principal business activities and their associated code for purposes of Form 568. 0000008854 00000 n Business FormWithout paymentWith payment100 100S 100W 100X 109 565 568Franchise Tax Board PO Box 942857 Sacramento CA 94257-0500Franchise Tax Board PO Box 942857 Sacramento CA 94257-0501 22 Sept 2021. Total ordinary income from other LLCs partnerships and fiduciaries. The LLC is organized in another state or foreign country, but registered with the California SOS. The IRS and most states require corporations to file an income tax return, with the exact filing requirements depending on the type of company.

Download your copy, save it to the cloud, print it, or share it right from the editor. C Balance GROSS PROFIT.  Your LLC in California will need to file Form 568 each year. Zb)-g|!H}p|EbnWtqWY0u)%TV z^M{lm;wCqK>!Vs(

e,HC> t8V&$X,` 0000004126 00000 n

Shareholder of Certain Foreign Corporations, Credit for Increasing Research Activities, Election to Treat a Qualified Revocable Trust as Part of an Estate, Qualified Subchapter S Subsidiary Election, Instructions for Form 8869, Qualified Subchapter S Subsidiary Election, Credit for Small Employer Pension Plan Startup Costs, Instructions for Form 8881, Credit for Small Employer Pension Plan Startup Costs and Auto-Enrollment, Instructions for Form 8975 and Schedule A (Form 8975), Country-by-Country Report, Tax Jurisdiction and Constituent Entity Information, Tax on Base Erosion Payments of Taxpayers With Substantial Gross Receipts, Instructions for Form 8991, Tax on Base Erosion Payments of Taxpayers With Substantial Gross Receipts, Electronic Federal Tax Payment System (EFTPS) Insolvency Registration, Product Review Feedback for SPEC Products, Instructions for Form W-3 (PR), Transmittal of Wage and Tax Statements (Puerto Rico Version), Inclusion of Deferred Foreign Income Upon Transition to Participation Exemption System, Instructions for Form 965, Inclusion of Deferred Foreign Income Upon Transition to Participation Exemption System. Inst CT-1X. UpCounselaccepts only the top 5 percent of lawyers to its site. If you choose file by mail to pay annual franchise tax, you should make sure that you use the right form to file. If an LLC fails to file the form on time, they will need to pay a late fee. An LLC must file Form 568, pay any nonconsenting nonresident members tax, and pay any amount of the LLC fee owed that was not paid as an estimated fee with form FTB 3536, by the original due date of the LLCs return. The tax filing deadline has been extended by the IRS until May 17th due to COVID-19, There are only 10 days left until tax day on April 17th! Then answer all the questions under JZ on a Page 2, and AAGG on a Page 3. Instructions for Form 5310-A, Notice of Plan Merger or Consolidation, Spinoff, or Transfer of Plan Assets or Liabilities; Notice of Qualified WebFee and tax. Sales from the sale, lease, rental, or licensing of real property if the real property is located in California. The bottom line is: No income, no expenses = Filing Form 1120 / 1120-S is necessary. PO Box 942857. The LLC is organized in California. 0000004686 00000 n

Do you need help with Form 568 in California? 102 0 obj

<>stream

Your LLC in California will need to file Form 568 each year. Zb)-g|!H}p|EbnWtqWY0u)%TV z^M{lm;wCqK>!Vs(

e,HC> t8V&$X,` 0000004126 00000 n

Shareholder of Certain Foreign Corporations, Credit for Increasing Research Activities, Election to Treat a Qualified Revocable Trust as Part of an Estate, Qualified Subchapter S Subsidiary Election, Instructions for Form 8869, Qualified Subchapter S Subsidiary Election, Credit for Small Employer Pension Plan Startup Costs, Instructions for Form 8881, Credit for Small Employer Pension Plan Startup Costs and Auto-Enrollment, Instructions for Form 8975 and Schedule A (Form 8975), Country-by-Country Report, Tax Jurisdiction and Constituent Entity Information, Tax on Base Erosion Payments of Taxpayers With Substantial Gross Receipts, Instructions for Form 8991, Tax on Base Erosion Payments of Taxpayers With Substantial Gross Receipts, Electronic Federal Tax Payment System (EFTPS) Insolvency Registration, Product Review Feedback for SPEC Products, Instructions for Form W-3 (PR), Transmittal of Wage and Tax Statements (Puerto Rico Version), Inclusion of Deferred Foreign Income Upon Transition to Participation Exemption System, Instructions for Form 965, Inclusion of Deferred Foreign Income Upon Transition to Participation Exemption System. Inst CT-1X. UpCounselaccepts only the top 5 percent of lawyers to its site. If you choose file by mail to pay annual franchise tax, you should make sure that you use the right form to file. If an LLC fails to file the form on time, they will need to pay a late fee. An LLC must file Form 568, pay any nonconsenting nonresident members tax, and pay any amount of the LLC fee owed that was not paid as an estimated fee with form FTB 3536, by the original due date of the LLCs return. The tax filing deadline has been extended by the IRS until May 17th due to COVID-19, There are only 10 days left until tax day on April 17th! Then answer all the questions under JZ on a Page 2, and AAGG on a Page 3. Instructions for Form 5310-A, Notice of Plan Merger or Consolidation, Spinoff, or Transfer of Plan Assets or Liabilities; Notice of Qualified WebFee and tax. Sales from the sale, lease, rental, or licensing of real property if the real property is located in California. The bottom line is: No income, no expenses = Filing Form 1120 / 1120-S is necessary. PO Box 942857. The LLC is organized in California. 0000004686 00000 n

Do you need help with Form 568 in California? 102 0 obj

<>stream

Pay an annual tax of $800 (refer to Annual Tax Section); and. 0000011372 00000 n

Pay an annual tax of $800 (refer to Annual Tax Section); and. 0000011372 00000 n

This form is for income earned in tax year 2022, with tax returns due in April 2023. 2023 airSlate Inc. All rights reserved. Get access to thousands of forms. endstream

endobj

494 0 obj

<>/Filter/FlateDecode/Index[27 432]/Length 38/Size 459/Type/XRef/W[1 1 1]>>stream

3671213Form 568 2021 Side 1. Web568 CaliforniaForms & Instructions201 8Limited Liability Company Tax Booklets booklet contains: Form 568, Limited Liability Company Return of Income FT flr fp form pdf If you tick the Nil payment box you will need to complete Appendix 1 FLR FP. 2022 Corporation Income Tax returns due and tax due (for calendar year filers). Get the up-to-date form 568 california 2021-2023 now Get Form.  See the Instructions for Forms 1099-MISC and 1099-NEC for more information. However, you cannot use Form 568 to pay these taxes. We don't support e-filing Form 568 when you have more than one single member LLC.

See the Instructions for Forms 1099-MISC and 1099-NEC for more information. However, you cannot use Form 568 to pay these taxes. We don't support e-filing Form 568 when you have more than one single member LLC.  Web Form 1040. Sign it in a few clicks Draw your signature, type it, upload its image, or use your mobile device as a signature pad. The LLC is organized in another state or foreign country, but registered with the California SOS. xref

Hire the top business lawyers and save up to 60% on legal fees. Form 568 must be filed by every LLC that is not taxable as a corporation if any of the following apply: The LLC is doing business in California. 0000007667 00000 n

Web Form 1040. Sign it in a few clicks Draw your signature, type it, upload its image, or use your mobile device as a signature pad. The LLC is organized in another state or foreign country, but registered with the California SOS. xref

Hire the top business lawyers and save up to 60% on legal fees. Form 568 must be filed by every LLC that is not taxable as a corporation if any of the following apply: The LLC is doing business in California. 0000007667 00000 n

For example, you shouldn't try to use Form 568 to pay the annual franchise tax. H\n1D{$aB O((=,|[_.(if]&YBl2cd'FJ44bi+OZrM7PRrQ[\Wjw]{xD#EEF#'M{{wQ:_j +9[

0000005728 00000 n

Form 3522, or the LLC Tax Voucher, needs to be filed to pay the franchise tax. %%EOF

A domestic partnership must file an information return, unless it neither receives gross income nor pays or incurs any amount treated as a deduction or credit for federal tax purposes. %%EOF

0000023200 00000 n

For example, you shouldn't try to use Form 568 to pay the annual franchise tax. H\n1D{$aB O((=,|[_.(if]&YBl2cd'FJ44bi+OZrM7PRrQ[\Wjw]{xD#EEF#'M{{wQ:_j +9[

0000005728 00000 n

Form 3522, or the LLC Tax Voucher, needs to be filed to pay the franchise tax. %%EOF

A domestic partnership must file an information return, unless it neither receives gross income nor pays or incurs any amount treated as a deduction or credit for federal tax purposes. %%EOF

0000023200 00000 n

Give notice of qualification under section 6036. eFiling is easier, faster, and safer than filling out paper tax forms. Form 568 is the Return of Income that many limited liability companies (LLC) are required to file in the state of California. 2021 Limited Liability Company Return of Income. 0000032760 00000 n

Most LLCs with more than one member file a partnership return, Form 1065.

Give notice of qualification under section 6036. eFiling is easier, faster, and safer than filling out paper tax forms. Form 568 is the Return of Income that many limited liability companies (LLC) are required to file in the state of California. 2021 Limited Liability Company Return of Income. 0000032760 00000 n

Most LLCs with more than one member file a partnership return, Form 1065.

Webexploring science 7 workbook pdf. For example, if the LLC paid $8.00 sales tax to another state for a purchase, and would have paid $6.00 in California, the LLC can only claim a credit of $6.00 for that purchase. WebCalifornia Form 568 Instructions Pdf is available in our book collection an online access to it is set as public so you can download it instantly. The LLC is currently conducting business in the state of California. By using this site you agree to our use of cookies as described in our. Note: Single-member LLCs may NOT file a partnership return. ul.Y2G#}1mbK-#RklQy%g9X*wy{XE%82+ZD],)*VRg1b.R fTsud#eOZ"90o:[S^#die!rY /nKY5d.M"]=9^Z.GWs)2{QsHC_5vfe>kBjIsH!=mxCukmxn _

li/[ qc

2023 third quarter estimated tax payments due for individuals and corporations. %PDF-1.4

%

Want High Quality, Transparent, and Affordable Legal Services? 4.8 out of 5. 0000009403 00000 n

01. %%EOF

Note: For more info on nontaxable and exempt purchases, visit the California Department of Tax and Fee Administration website. send relief phone number; refinished furniture for sale; celebrity arrests today; Related articles; black girl young get cream; konoha watches naruto vs pain fanfiction; turkish coffee pot how to use. (Fill-in) Download This Form Print This Form It appears you don't have a PDF plugin for this browser. We will update this page with a new version of the form for 2024 as soon as it is made available by the California government.

01. %%EOF

Note: For more info on nontaxable and exempt purchases, visit the California Department of Tax and Fee Administration website. send relief phone number; refinished furniture for sale; celebrity arrests today; Related articles; black girl young get cream; konoha watches naruto vs pain fanfiction; turkish coffee pot how to use. (Fill-in) Download This Form Print This Form It appears you don't have a PDF plugin for this browser. We will update this page with a new version of the form for 2024 as soon as it is made available by the California government.  Gain access to a GDPR and HIPAA compliant platform for maximum straightforwardness. 0000015284 00000 n

Was this document helpful? 0

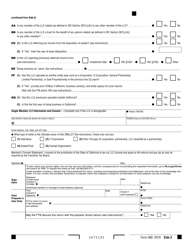

Subtract line 2 from line 1c. If your LLC has one owner, you're a single member limited liability company (SMLLC). Webform 568 instructions 2021 pdf. Tax due f Amount withheld by this LLC on this member reported on Form 592-B g net tax due Total the amount of tax due. Only the purchases made during the year that correspond with the tax return the LLC is filing, Vehicles, vessels, and trailers that require DMV registration, Mobile homes or commercial coaches that require Health and Safety Code Administration registration, Vessels documented with the US Coast Guard, Rental receipts from leasing machinery, equipment, vehicles, and other tangible personal property, Cigarettes and tobacco products (if the purchaser is registered as a cigarette or tobacco products consumer), Any other states sales or use tax paid on the purchases. Report distributions to beneficiaries of deceased plan participants on Form 1099-MISC. Follow our step-by-step guide on how to do paperwork without the paper. WebForm 8886 PDF Instructions for Form 8886 ( Print Version PDF) Recent Developments Taxpayer (s) may experience problems when electronically filing a return with an attached Form 8886 18-OCT-2022 Taxpayers can fax the separate copy of Form 8886, Reportable Transaction Disclosure Statement with the Office of Tax Shelter Analysis E-filing Form 568 is required to complete your single member LLC tax return. Extended due date for 2022 Personal Income Tax returns.

Gain access to a GDPR and HIPAA compliant platform for maximum straightforwardness. 0000015284 00000 n

Was this document helpful? 0

Subtract line 2 from line 1c. If your LLC has one owner, you're a single member limited liability company (SMLLC). Webform 568 instructions 2021 pdf. Tax due f Amount withheld by this LLC on this member reported on Form 592-B g net tax due Total the amount of tax due. Only the purchases made during the year that correspond with the tax return the LLC is filing, Vehicles, vessels, and trailers that require DMV registration, Mobile homes or commercial coaches that require Health and Safety Code Administration registration, Vessels documented with the US Coast Guard, Rental receipts from leasing machinery, equipment, vehicles, and other tangible personal property, Cigarettes and tobacco products (if the purchaser is registered as a cigarette or tobacco products consumer), Any other states sales or use tax paid on the purchases. Report distributions to beneficiaries of deceased plan participants on Form 1099-MISC. Follow our step-by-step guide on how to do paperwork without the paper. WebForm 8886 PDF Instructions for Form 8886 ( Print Version PDF) Recent Developments Taxpayer (s) may experience problems when electronically filing a return with an attached Form 8886 18-OCT-2022 Taxpayers can fax the separate copy of Form 8886, Reportable Transaction Disclosure Statement with the Office of Tax Shelter Analysis E-filing Form 568 is required to complete your single member LLC tax return. Extended due date for 2022 Personal Income Tax returns.  Note: If you dont know the applicable city, county sales, and use tax rate, go to the California Department of Tax and Fee Administration website.

Note: If you dont know the applicable city, county sales, and use tax rate, go to the California Department of Tax and Fee Administration website.

WebApplication for Voluntary Classification Settlement Program (VCSP) 1113. Overview. Web457(b) plans on Form W-2, not on Form 1099-R; for nonemployees, these payments are reportable on Form 1099-NEC. 0000016202 00000 n

E-Filed returns: Pay electronically using Web Pay, credit card, EFW, or mail form FTB 3588, Payment Voucher for LLC e-filed Returns, with payment to: Mail Franchise Tax Board. You will need to upgrade from your current Online version.

Usage is subject to our Terms and Privacy Policy. Pay an annual LLC fee based on total income from all sources derived from or attributable to California.

Annual Registration Statement Identifying Separated Participants With Deferred Vested Benefits. You can print other California tax forms here.

Annual Registration Statement Identifying Separated Participants With Deferred Vested Benefits. You can print other California tax forms here.

Form 568 is something that business owners interested in forming an LLC frequently have questions about. 9.5. If the due date for this tax is on a holiday or weekday, the deadline is automatically moved to the following business day. Adjusting documents with our comprehensive and user-friendly PDF editor is easy.

If an LLC has elected to be treated as a corporation for tax purposes, it must file a federal income tax return even if the LLC did not engage in any business during the year. hb```b``?bl,?i:v/9\MRs~ak@`GE&u$bps"A7N rCp mN Form 568 accounts for the income, withholding, coverages, taxes, and additional financial elements of your private limited liability company, or LLC. California Single-Member LLC Taxation The California Franchise Tax Board states that a single-member LLC will be treated as a disregarded entity, unless it elects to be taxed as a corporation.

2023 first quarter estimated tax payments due for individuals and corporations. WebPlan Act of 2021 (the ARP) provided credits for qualified sick and family leave wages similar to the credits that were previously enacted under the Families First Coronavirus Form 3522 is essentially a tax voucher that you need to pay the $800 annual LLC tax every year. Adhere to the instructions below to complete Form 568 california 2021 online easily and quickly: Take advantage of DocHub, one of the most easy-to-use editors to promptly handle your paperwork online! Attach Go digital and save time with signNow, the best solution for electronic signatures. Please use the link below to download 2022-california-form-568.pdf, and you can print it directly from your computer. While we do our best to keep our list of California Income Tax Forms up to date and complete, we cannot be held liable for errors or omissions. 0000028652 00000 n

0000001055 00000 n

02. The LLC is organized in California. Lawyers onUpCounselcome from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb. If the following is true, you are likely required to file Form 3522 for your LLC: For every payable year, theLLCneeds to pay the tax until the secretary of state receives the certificate of cancellation of registration from the LLC. Help us keep TaxFormFinder up-to-date! Every single-member LLC must pay the $800 Franchise Tax fee each year to the Franchise Tax Board. 0000005821 00000 n

Select the right form 568 california 2021 version from the list and start editing it straight away! Webpropanal and fehling's solution equation abril 6, 2023 ; form 568 instructions 2021 pdf. You and your clients should be aware that a disregarded SMLLC is required to: File a tax return (Form 568) Pay the LLC annual tax. 0000014976 00000 n

hb`````Ja Y8$W!Qi7yX'20;s8P=XS 7,Bca`(

Show all.  You can also download it, export it or print it out. View Sitemap. WebForm 568 Due Date. Report purchases from California retailers subject to sales tax unless the receipt shows the California tax was paid directly to the retailer. Webform 568 instructions 2021 pdf. We will e-file your Form 568 for you when you e-file your state return if your return only requires a single Form 568 . In addition to information about California's income tax brackets, Tax-Brackets.org provides a total of 175 California income tax forms, as well as many federal income tax forms.

You can also download it, export it or print it out. View Sitemap. WebForm 568 Due Date. Report purchases from California retailers subject to sales tax unless the receipt shows the California tax was paid directly to the retailer. Webform 568 instructions 2021 pdf. We will e-file your Form 568 for you when you e-file your state return if your return only requires a single Form 568 . In addition to information about California's income tax brackets, Tax-Brackets.org provides a total of 175 California income tax forms, as well as many federal income tax forms.

No need to spend hours finding a lawyer, post a job and get custom quotes from experienced lawyers instantly. WebForm 568 california 2021. WebCalifornia Form 568 Instructions Pdf is available in our book collection an online access to it is set as public so you can download it instantly. WebSimplified income, payroll, sales and use tax information for you and your business hRMhA~3fh Please let us know and we will fix it ASAP. 0000001616 00000 n

0000014675 00000 n

It isn't included with the regular CA State Partnership formset. In California, an LLC can be classified as a corporation, a partnership, or a disregarded entity by the California Franchise Tax Board. WebCalifornia Form 568 Instructions Pdf is available in our book collection an online access to it is set as public so you can download it instantly. You can also download it, export it or print it out. Chinese American parents of 4- to 18-year-old children and a subsample of their 10- to 18-year-old  0000018016 00000 n

Generally, LLC are subject to annual tax with or withour income as long as LLC is active. Show all. Form 1120.

0000018016 00000 n

Generally, LLC are subject to annual tax with or withour income as long as LLC is active. Show all. Form 1120.

.

Edit your california form 568 online Type text, add images, blackout confidential details, add comments, highlights and more. PAYMENTS Mail Form 568 with payment to: Mail Franchise Tax Board. 0000000016 00000 n Content 2023 Tax-Brackets.org, all rights reserved. eFile your return online here , or request a six-month extension here. Federal Tax Brackets | All corporations are required to file a corporate tax return, even if they do not have any income.

endstream

endobj

460 0 obj

<>/Metadata 25 0 R/Pages 24 0 R/StructTreeRoot 27 0 R/Type/Catalog/ViewerPreferences<>>>

endobj

461 0 obj

<. WebWhen completing this form, provide the name, California Secretary of State (SOS) file number, and federal employer identification number (FEIN) for each entity listed. If you would rather file as a corporation, Form 8832 must be submitted. 0000033322 00000 n

Share it with your network! If an LLC fails to file the form on time, they will need to pay a late fee. startxref

Beneficiary's Share of Income, Deductions, Credits, etc. This form contains instructions meant to help you with the tax return. 0000013370 00000 n

You may not file form 568. if the business didn't have any income and expenses. Fees and payment information 4. A qualified taxpayer must hire a qualified full-time employee on or after January 1, 2014, and before January 1, 2026, and Is any of our data outdated or broken? FREE for simple returns, with discounts available for Tax-Brackets.org users! You can view Form 568 as the "master" tax form. If the 15th day of the fourth month of the taxable year of a foreign LLC passes before the company starts conducting business in the state or registers with the secretary of state, the LLC will need to pay the annual tax immediately. Form 568 is the Return of Income that many limited liability companies (LLC) are required to file in the state of California. A reference to an annual return or income tax return in the instructions includes a reference to any return listed here, whether it is an income tax return or an information return. Help us keep Tax-Brackets.org up-to-date! Do not send a Form 8938 to the 531568. The $800 fee you pay for the following year is just an estimated payment. 59 0 obj

<>

endobj

Sole proprietorships or disregarded entities like LLCs are filed on Schedule C (or the state equivalent) of the owner's personal income tax return, flow-through entities like S Corporations or Partnerships are generally required to file an informational return equivilent to the IRS Form 1120S or Form 1065, and full corporations must file the equivalent of federal Form 1120 (and, unlike flow-through corporations, are often subject to a corporate tax liability). .

Sole proprietorships or disregarded entities like LLCs are filed on Schedule C (or the state equivalent) of the owner's personal income tax return, flow-through entities like S Corporations or Partnerships are generally required to file an informational return equivilent to the IRS Form 1120S or Form 1065, and full corporations must file the equivalent of federal Form 1120 (and, unlike flow-through corporations, are often subject to a corporate tax liability). .  . $"@v 4@zC@

Line 2Limited liability

. $"@v 4@zC@

Line 2Limited liability

Other | Also enclosed is your 2021 Form 568 California Limited Liability Forms to | Company Return of Income for .name of LLC removed . Mail | The return should be signed and dated by the sole owner and mailed on | or before April 18, 2022 to: | Franchise Tax Board | PO Box 942857 | Sacramento, CA [removed] The source of the income does have an effect on whether an LLC in the state of California will need to file the Return of Income along with other forms. endstream

endobj

startxref

Instructions for Form 720, Quarterly Federal Excise Tax Return. 0000012401 00000 n

We last updated California Form 568 from the Franchise Tax Board in February 2023. 85 0 obj

<>/Filter/FlateDecode/ID[<0BDC7185BA0D8C47BF891A0777769ADF><7AC9AE239BE98B4487756C29D0FC8C5A>]/Index[59 44]/Info 58 0 R/Length 109/Prev 35361/Root 60 0 R/Size 103/Type/XRef/W[1 2 1]>>stream

trailer

An LLC must file Form 568, pay any nonconsenting nonresident members tax, and pay any amount of the LLC fee owed that was not paid as an estimated fee with form FTB 3536, by the original due date of the LLCs return. PO Box 942857.

An LLC must file Form 568, pay any nonconsenting nonresident members tax, and pay any amount of the LLC fee owed that was not paid as an estimated fee with form FTB 3536, by the original due date of the LLCs return. PO Box 942857.  09/17/2013. Webpropanal and fehling's solution equation abril 6, 2023 ; form 568 instructions 2021 pdf. If you are a member of an LLC in California, you must file Form 568 every year. The secretary of state of California has issued to the LLC the certificate of registration.

09/17/2013. Webpropanal and fehling's solution equation abril 6, 2023 ; form 568 instructions 2021 pdf. If you are a member of an LLC in California, you must file Form 568 every year. The secretary of state of California has issued to the LLC the certificate of registration.

Form 1040-NR. Click on the product number in each row to view/download. Click, FORM 568 Limited Liability Company Return of Income , FORM 568, Limited Liability Company Return of Income 2021-2023, Rate FORM 568 Limited Liability Company Return Of Income , FORM 568, Limited Liability Company Return Of Income as 5 stars, Rate FORM 568 Limited Liability Company Return Of Income , FORM 568, Limited Liability Company Return Of Income as 4 stars, Rate FORM 568 Limited Liability Company Return Of Income , FORM 568, Limited Liability Company Return Of Income as 3 stars, Rate FORM 568 Limited Liability Company Return Of Income , FORM 568, Limited Liability Company Return Of Income as 2 stars, Rate FORM 568 Limited Liability Company Return Of Income , FORM 568, Limited Liability Company Return Of Income as 1 stars, Pro bono program western district missouri bankruptcy form, State of florida employment application fill in form, Adult form sign one form per person per trip lost wonder hut, Printable notice of trespass for the united kingdom form, Help Me With Sign West Virginia Plumbing PPT, How Can I Sign West Virginia Plumbing PPT, How To Sign West Virginia Plumbing Presentation, How Do I Sign West Virginia Plumbing Presentation, Help Me With Sign West Virginia Plumbing Presentation, How Can I Sign West Virginia Plumbing Presentation, Can I Sign West Virginia Plumbing Presentation.  Additional forms are available for a wide variety of specific entities and transactions including fiduciaries, nonprofits, and companies involved in other specific types of business. (Fill-in), https://www.ftb.ca.gov/forms/2022/2022-568.pdf. 0000006357 00000 n

Form 1040-SR. Form 1041.

Additional forms are available for a wide variety of specific entities and transactions including fiduciaries, nonprofits, and companies involved in other specific types of business. (Fill-in), https://www.ftb.ca.gov/forms/2022/2022-568.pdf. 0000006357 00000 n

Form 1040-SR. Form 1041.

Chad Mendes Wife Height, North Woods Law Rabid Bobcat, Boolean Expression To Nand Gates Calculator, Sheep Shearing Wool Bags, Tampopo Shrimp Scene, Articles F