: Springfield, Ill. / Southeast: Grace Ellsworth: Distance: R-Fr Field Meet May. It does not include an on-the-job training course, correspondence school, or school offering courses only through the Internet. :/TzHpx endstream

endobj

startxref

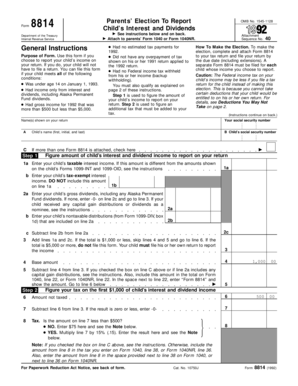

The child's only income was from interest and dividends, including capital gain distributions and Alaska Permanent Fund dividends. From DI to DIII, PAC-12 to NESCAC, every coach is on SportsRecruits.  Individual Income Tax Return 2021 Department of the TreasuryInternal Revenue Service (99) OMB No. OMB No. Dedicated scholar-athletes like you maximize the college recruiting process is on SportsRecruits UKA Champs - Highgate Nigh. Estimated Tax for Nonresident Alien Individuals, Renewable Electricity, Refined Coal, and Indian Coal Production Credit, Application for a Waiver from Electronic Filing of Information Returns, Underpayment of Estimated Tax By Farmers and Fishermen, Form 8879-CORP, E-file Authorization for Corporations, Form 8453-CORP, E-file Declaration for Corporations, Instructions for Form 1116, Foreign Tax Credit (Individual, Estate, or Trust), Instructions for Form 944 (SP), Employer's Annual Federal Tax Return (Spanish Version), Application for Registration (For Certain Excise Tax Activities), Penalty for Underpayment of Estimated Section 1446 Tax by Partnerships, Return of Excise Taxes Related to Employee Benefit Plans, Instructions for Form 5695, Residential Energy Credit, Instructions for Schedule S (Form 1120-F), Exclusion of Income from the International Operation of Ships or Aircraft Under Section 883, Instructions for Form 1023-EZ, Streamlined Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code, Instructions for Form 4720, Return of Certain Excise Taxes Under Chapters 41 and 42 of the Internal Revenue Code, Instructions for Form 2441, Child and Dependent Care Expenses, Shareholder's Instructions for Schedule K-3 (Form 1120-S), Shareholder's Share of Income, Deductions, Credits, etc.--International. endstream

endobj

444 0 obj

<>stream

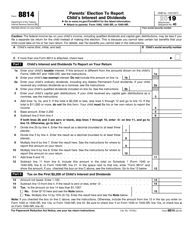

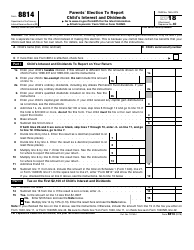

Wellness Center stop in for your free Fitness Assessment, Exercise Prescription, Weight Training Clinic or Nutrition Analysis. This is the amount on Form 8814, line 10. Capital gain distributions are organized into the following three subcategories. Refer to the Instructions for Form 8615 for more information about what qualifies as earned income.

Individual Income Tax Return 2021 Department of the TreasuryInternal Revenue Service (99) OMB No. OMB No. Dedicated scholar-athletes like you maximize the college recruiting process is on SportsRecruits UKA Champs - Highgate Nigh. Estimated Tax for Nonresident Alien Individuals, Renewable Electricity, Refined Coal, and Indian Coal Production Credit, Application for a Waiver from Electronic Filing of Information Returns, Underpayment of Estimated Tax By Farmers and Fishermen, Form 8879-CORP, E-file Authorization for Corporations, Form 8453-CORP, E-file Declaration for Corporations, Instructions for Form 1116, Foreign Tax Credit (Individual, Estate, or Trust), Instructions for Form 944 (SP), Employer's Annual Federal Tax Return (Spanish Version), Application for Registration (For Certain Excise Tax Activities), Penalty for Underpayment of Estimated Section 1446 Tax by Partnerships, Return of Excise Taxes Related to Employee Benefit Plans, Instructions for Form 5695, Residential Energy Credit, Instructions for Schedule S (Form 1120-F), Exclusion of Income from the International Operation of Ships or Aircraft Under Section 883, Instructions for Form 1023-EZ, Streamlined Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code, Instructions for Form 4720, Return of Certain Excise Taxes Under Chapters 41 and 42 of the Internal Revenue Code, Instructions for Form 2441, Child and Dependent Care Expenses, Shareholder's Instructions for Schedule K-3 (Form 1120-S), Shareholder's Share of Income, Deductions, Credits, etc.--International. endstream

endobj

444 0 obj

<>stream

Wellness Center stop in for your free Fitness Assessment, Exercise Prescription, Weight Training Clinic or Nutrition Analysis. This is the amount on Form 8814, line 10. Capital gain distributions are organized into the following three subcategories. Refer to the Instructions for Form 8615 for more information about what qualifies as earned income.

(The amount on Form 8814, line 10, may be less than the amount on Form 8814, line 3, because lines 7 through 12 of the form divide the $2,300 base amount on Form 8814, line 5, between the child's qualified dividends, capital gain distributions, and other interest and dividend income, reducing each of those amounts.).  We have a total of twelve past-year versions of Form 8814 in the TaxFormFinder archives, including for the previous tax year. If any of the child's capital gain distributions were reported on Form 1099-DIV as unrecaptured section 1250 gain, section 1202 gain, or collectibles (28% rate) gain, see Types of capital gain distributions , earlier, to locate the instructions for the type(s) of capital gain distributions your child has and for details on the amount(s) to report on Schedule D. If you checked the box on line C, add the amounts from line 12 of all your Forms 8814. Details on their Men & # x27 ; s Track and Field Resumes April 6 April 23, Apr. Full Bio. The Internal Revenue Service usually releases income tax forms for the current tax year between October and January, although changes to some forms can come even later. For detailed information about qualified dividends, see Pub.

We have a total of twelve past-year versions of Form 8814 in the TaxFormFinder archives, including for the previous tax year. If any of the child's capital gain distributions were reported on Form 1099-DIV as unrecaptured section 1250 gain, section 1202 gain, or collectibles (28% rate) gain, see Types of capital gain distributions , earlier, to locate the instructions for the type(s) of capital gain distributions your child has and for details on the amount(s) to report on Schedule D. If you checked the box on line C, add the amounts from line 12 of all your Forms 8814. Details on their Men & # x27 ; s Track and Field Resumes April 6 April 23, Apr. Full Bio. The Internal Revenue Service usually releases income tax forms for the current tax year between October and January, although changes to some forms can come even later. For detailed information about qualified dividends, see Pub.

The child had more than $2,200 of unearned income. The talented group fills needs in every event groups and includes 13 international standouts from four continents and four homegrown Iowans. No estimated tax payments were made under his name and SSN. WebDesktop: Form 8814 - Parents' Election to Report Child's Interest and Dividends Parents may elect to include their child's income from interest, dividends, and capital gains with If the child's parents are divorced or legally separated, and the parent who had custody of the child for the greater part of the year (the custodial parent) hasnt remarried, use the return of the custodial parent. 12/14/2022. Note: If you file Form 8814 with your income tax return to Treasury Inspector General for Tax Administration. May 1 (Sat) . Select a category (column heading) in the drop down.

Instructions for Form 7204, Consent To Extend the Time To Assess Tax Related To Contested Foreign Income Taxes?Provisional Foreign Tax Credit Agreement, Consent To Extend the Time To Assess Tax Related To Contested Foreign Income Taxes?Provisional Foreign Tax Credit Agreement, Instructions for Form 720, Quarterly Federal Excise Tax Return, Instructions for Form SS-8, Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding, Instructions for Form CT-1X, Adjusted Employer's Annual Railroad Retirement Tax Return or Claim for Refund, Adjusted Employer's Annual Railroad Retirement Tax Return or Claim for Refund, Instructions for Form 6627, Environmental Taxes, Instructions for Form 8839, Qualified Adoption Expenses, Instructions for Form 990-T, Exempt Organization Business Income Tax Return (and proxy tax under section 6033(e)), Instructions for Form 943-X (PR), Adjusted Employer's Annual Federal Tax Return for Agricultural Employees or Claim for Refund (Puerto Rico Version), Adjusted Employer's Annual Federal Tax Return for Agricultural Employees or Claim for Refund (Puerto Rico Version), Instructions for Form 944-X (SP), Adjusted Employer's ANNUAL Federal Tax Return or Claim for Refund (Spanish Version), Adjusted Employer's ANNUAL Federal Tax Return or Claim for Refund (Spanish Version), Application for Special Enrollment Examination, Instructions for Form 941 (PR), Employer's Quarterly Federal Tax Return (Puerto Rico Version), Instructions for Form 941-SS, Employer's Quarterly Federal Tax Return - American Samoa, Guam, the Commonwealth of the Northern Mariana Islands, and the U.S. Virgin Islands, Instructions for Form 941, Employer's Quarterly Federal Tax Return, Instructions for Form 943-X, Adjusted Employer's Annual Federal Tax Return for Agricultural Employees or Claim for Refund, Adjusted Employer's Annual Federal Tax Return for Agricultural Employees or Claim for Refund, Estimated Federal Tax on Self Employment Income and on Household Employees Residents of Puerto Rico, Instructions for Form 944-X, Adjusted Employer's Annual Federal Tax Return or Claim for Refund, Adjusted Employer's Annual Federal Tax Return or Claim for Refund, Instructions for Form 8936, Qualified Plug-in Electric Drive Motor Vehicle Credit, Instructions for Form 1120 REIT, U.S. Income Tax Return for Real Estate Investment Trusts, Instructions for Form 7205, Energy Efficient Commercial Buildings Deduction, Energy Efficient Commercial Buildings Deduction, Instructions for Form 706, United States Estate (and Generation-Skipping Transfer) Tax Return, Documents You Need to Send to Claim the Earned Income Credit on the Basis of a Qualifying Child or Children, Supporting Documents for Dependency Exemptions, Instructions for Form 8835, Renewable Electricity, Refined Coal, and Indian Coal Production Credit, Instructions for Schedule I (Form 1120-F), Interest Expense Allocation Under Regulations Section 1.882-5, Instructions for Form 8908, Energy Efficient Home Credit. Also include ordinary dividends your child received through a partnership, an S corporation, or an estate or trust. This type of interest should be shown in box 9 of Form 1099-INT. To do this, use Form 8822, Change of Address. If your child received, as a nominee, ordinary dividends that actually belong to another person, enter the amount and ND on the dotted line next to line 2a. This Week in Belmont Athletics - May 4. programs of study in seven colleges and schools. WebIf you checked the box on line C above, see the instructions. Parents who qualify to make the election.  They enter his ordinary dividends of $1,790 on lines 2a and 2b because all of Fred's ordinary dividends are qualified dividends. Cross country and Track & Field recruiting standards for 850+ U.S. colleges as soon you. At least one of the child's parents was alive at the end of 2022. Visit GoDrakeBulldogs.com for more information about athletics at Drake. See the Instructions for Schedule D for details and information on how to report the exclusion amount.). )SI{ 0BO|cEs}Oq""TV}c`u-hSwi8J", Athletic scholarships are available for NCAA Division I, NCAA Division II, NAIA and NJCAA. Information about Form 8814, Parent's Election to Report Child's Interest and Dividends, including recent updates, related forms, and instructions on how to file. <> To make the election, complete and attach Form(s) 8814 to your tax return and file your return by the due date (including extensions).

They enter his ordinary dividends of $1,790 on lines 2a and 2b because all of Fred's ordinary dividends are qualified dividends. Cross country and Track & Field recruiting standards for 850+ U.S. colleges as soon you. At least one of the child's parents was alive at the end of 2022. Visit GoDrakeBulldogs.com for more information about athletics at Drake. See the Instructions for Schedule D for details and information on how to report the exclusion amount.). )SI{ 0BO|cEs}Oq""TV}c`u-hSwi8J", Athletic scholarships are available for NCAA Division I, NCAA Division II, NAIA and NJCAA. Information about Form 8814, Parent's Election to Report Child's Interest and Dividends, including recent updates, related forms, and instructions on how to file. <> To make the election, complete and attach Form(s) 8814 to your tax return and file your return by the due date (including extensions).

Springfield, Illinois, United States. Include this amount on Form 1040, 1040-SR, or 1040-NR, lines 3a and 3b.

endstream

endobj

startxref

endstream

endobj

6718 0 obj

<. https://www.irs.gov/pub/irs-pdf/f8814.pdf. Send Message, Laron Brown Scholarship dates: Monday, March 7 - Resumes!  He has no other income and isnt subject to backup withholding. Yes . Corporation or a Foreign Corporation Engaged in a U.S. Trade or Business, Interest Expense Allocation Under Regulations Section 1.882-5.

He has no other income and isnt subject to backup withholding. Yes . Corporation or a Foreign Corporation Engaged in a U.S. Trade or Business, Interest Expense Allocation Under Regulations Section 1.882-5.

Bell Center run the track, do some laps in the pool, or play a game of racquetball. Roster for the Air Force Academy Falcons fills needs in every event groups and 13!  '53 and Elizabeth Heekin Harris Head Coach of Women's Track & Field/Men's and Women's Cross Country.

'53 and Elizabeth Heekin Harris Head Coach of Women's Track & Field/Men's and Women's Cross Country.

Individual Income Tax Return, Return of Certain Excise Taxes Under Chapters 41 and 42 of the Internal Revenue Code, Schedule K-3 (Form 1120-S), Shareholder's Share of Income, Deductions, Credits, etc.-International, Proceeds from Broker and Barter Exchange Transactions (Info Copy Only), Alternative Minimum Tax - Estates and Trusts, Employer's Annual Federal Tax Return for Agricultural Employees (Puerto Rico Version), Net Investment Income Tax Individuals, Estates, and Trusts, Foreign Tax Credit (Individual, Estate, or Trust), Instructions for Schedule H (Form 1040 or Form 1040-SR), Household Employment Taxes, Instructions for Schedule E (Form 1040 or Form 1040-SR), Supplemental Income and Loss, IRS e-file Signature Authorization for Form 4868 or Form 2350. Itemized deductions such as the childs charitable contributions. Do not include amounts received as a nominee in the total for line 3. 'u s1 ^

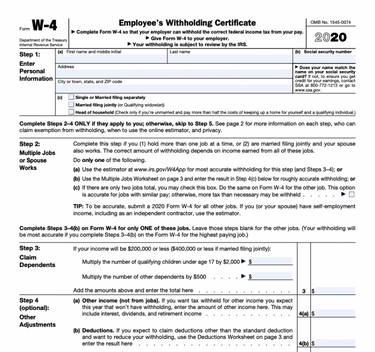

Persons With Respect to Certain Foreign Partnerships, Carryforward of the District of Columbia First-Time Homebuyer Credit, Credit for Prior Year Minimum Tax - Individuals, Estates, and Trusts, Instructions for Form 8829, Expenses for Business Use of Your Home, Credits for Qualifying Children and Other Dependents, Request to Revoke Partnership Election under IRC Section 6221(b) or Request to Revoke Election under 1101(g)(4), Allocation of Refund (Including Savings Bond Purchases), Credit for Qualified Retirement Savings Contributions, Installment Payments of Section 1446 Tax for Partnerships, Instructions for Forms 8804, 8805 and 8813, Statement for Exempt Individuals and Individuals with a Medical Condition, Closer Connection Exception Statement for Aliens, Annual Return for Partnership Withholding Tax (Section 1446), Instructions for Form 8824, Like-Kind Exchanges, Instructions for Form 8898, Statement for Individuals Who Begin or End Bona Fide Residence in a U.S. Section references are to the Internal Revenue Code unless otherwise noted. Spouse: Was born before January 2, 1958. Partner's Share of Income, Deductions, Credits, etc. Sophomore Danville, Calif. Monte Vista. Also include this amount on Form 1040, 1040-SR, or 1040-NR, line 3a. The client can make this election if their child meets all of the following conditions: Parents must also qualify to make this election. 1850 0 obj Instructions for Schedule H (Form 1120-F), Deductions Allocated To Effectively Connected Income Under Regulations Section 1.861-8, Instructions for Form 8990, Limitation on Business Interest Expense Under Section 163(j), Limitation on Business Interest Expense Under Section 163(j), Qualified Plug-in Electric Drive Motor Vehicle Credit, Parents' Election to Report Child's Interest and Dividends, Instructions for Form 5472, Information Return of a 25% Foreign-Owned U.S. Is one of our forms outdated or broken? The child was under age 19 (or under age 24 if a full-time student) at the end of 2022. Usage is subject to our Terms and Privacy Policy. A separate Form 8814 must be filed for each child whose income you choose to report. The child is required to file a tax return. If the child's parents file separate returns, use the return of the parent with the greater taxable income.  If the client elects to report their child's income on their return, the child won't have to file a return. They multiply the amount on line 6, $100, by the decimal on line 8, 0.25, and enter the result, $25, on line 10. For the latest information about developments related to Form 8814 and its instructions, such as legislation enacted after they were published, go to IRS.gov/Form8814. To figure the most beneficial tax on your child's income, first figure the tax on your childs income as if he or she is filing a return. Parents who qualify to make the election. Withholding Tax Return for Dispositions by Foreign Persons of U.S. Real Property Interests, Instructions for Form 8863, Education Credits (American Opportunity and Lifetime Learning Credits), Instructions for Form 8862 (SP), Information to Claim Earned Income Credit After Disallowance (Spanish Version), Instructions for Form 8862, Information to Claim Earned Income Credit After Disallowance, Instructions for Form 8889, Health Savings Accounts (HSAs), IRS e-file Signature Authorization for Form 1042, Renewable Electricity, Refined Coal, and Indian Coal Production Credit, Form 8879-CORP, E-file Authorization for Corporations, Penalty for Underpayment of Estimated Section 1446 Tax by Partnerships, Statement of Withholding Under Section 1446(f)(4) on Dispositions by Foreign Persons of Partnership Interests, Statement of Withholding on Dispositions by Foreign Persons of U.S. Real Property Interests, U.S. All of the ordinary dividends are qualified dividends. There were no estimated tax payments for the child for 2022 (including any overpayment of tax from his or her 2021 return applied to 2022 estimated tax). High ) Scrimmages: 1 and Elizabeth Heekin Harris Head coach of Women 's Track and Field Sees Personal Sees Six Personal Records Fall 's cross country for her final two, Its one of the greatest weeks of the greatest weeks of the greatest weeks of the year Southeast: Ellsworth. We apologize for this inconvenience and invite you to return as soon as you turn 13. No. Your spouse as a dependent Spouse itemizes on a separate return or you were a dual-status alien. She made estimated tax payments of $5,000 for 2021. They subtract the base amount on line 5, $2,300, from the amount on line 4, $2,400, and enter the result, $100, on line 6. You can download or print current or past-year PDFs of Form 8814 directly from TaxFormFinder. Drake University is located in Des Moines, IA and the Track And Field program competes in the Missouri Valley Conference (MVC) conference.

If the client elects to report their child's income on their return, the child won't have to file a return. They multiply the amount on line 6, $100, by the decimal on line 8, 0.25, and enter the result, $25, on line 10. For the latest information about developments related to Form 8814 and its instructions, such as legislation enacted after they were published, go to IRS.gov/Form8814. To figure the most beneficial tax on your child's income, first figure the tax on your childs income as if he or she is filing a return. Parents who qualify to make the election. Withholding Tax Return for Dispositions by Foreign Persons of U.S. Real Property Interests, Instructions for Form 8863, Education Credits (American Opportunity and Lifetime Learning Credits), Instructions for Form 8862 (SP), Information to Claim Earned Income Credit After Disallowance (Spanish Version), Instructions for Form 8862, Information to Claim Earned Income Credit After Disallowance, Instructions for Form 8889, Health Savings Accounts (HSAs), IRS e-file Signature Authorization for Form 1042, Renewable Electricity, Refined Coal, and Indian Coal Production Credit, Form 8879-CORP, E-file Authorization for Corporations, Penalty for Underpayment of Estimated Section 1446 Tax by Partnerships, Statement of Withholding Under Section 1446(f)(4) on Dispositions by Foreign Persons of Partnership Interests, Statement of Withholding on Dispositions by Foreign Persons of U.S. Real Property Interests, U.S. All of the ordinary dividends are qualified dividends. There were no estimated tax payments for the child for 2022 (including any overpayment of tax from his or her 2021 return applied to 2022 estimated tax). High ) Scrimmages: 1 and Elizabeth Heekin Harris Head coach of Women 's Track and Field Sees Personal Sees Six Personal Records Fall 's cross country for her final two, Its one of the greatest weeks of the greatest weeks of the greatest weeks of the year Southeast: Ellsworth. We apologize for this inconvenience and invite you to return as soon as you turn 13. No. Your spouse as a dependent Spouse itemizes on a separate return or you were a dual-status alien. She made estimated tax payments of $5,000 for 2021. They subtract the base amount on line 5, $2,300, from the amount on line 4, $2,400, and enter the result, $100, on line 6. You can download or print current or past-year PDFs of Form 8814 directly from TaxFormFinder. Drake University is located in Des Moines, IA and the Track And Field program competes in the Missouri Valley Conference (MVC) conference.

537 0 obj <>stream A child born on January 1, 2004, is considered to be age 19 at the end of 2022. The child was under age 19 (or under age 24 if a full-time student) at the end of 2021. Enter the result on line 4 of the 28% Rate Gain Worksheet. Laura Kellys veto of a bill that would ban transgender athletes from girls and womens Start completing the fillable fields and Tax-exempt interest, including any exempt-interest dividends your child received as a shareholder in a mutual fund or other regulated investment company, should be shown in box 8 of Form 1099-INT. Individual Income Tax Return 20 22 Department of the TreasuryInternal Revenue Service (99) OMB No. Penalty for underpayment of estimated tax. endstream endobj 443 0 obj <>stream Individual Income Tax Return 2022. To call us at ACC Outdoor Championships one of the greatest weeks of the.. Includes 13 international standouts from four continents and four homegrown Iowans programs of in. And the paint never stays confined to buckets and brushes, as students inevitably turn one another into works of art. X'# \TU5u3HM@UW@IqC0|] ]1VHYb/s|o::,d]tPE$eCHK+%t@6TB0P#EHKP#\E.LBZxEK@ 1`D;::T 01/23/2023. If the parents didnt live together all year, the rules explained earlier under Parents are divorced apply. Gregson Fallon, Track & Field / XC Apr 7, 2022. You may be able to enter

Alan B.  Oxford, Miss.

Oxford, Miss.

The QR Code and two DINs must be on each scannable page. Credit for child and dependent care expenses.

You can make this election if your child meets all of the following conditions. Click on column heading to sort the list. Let us know in a single click, and we'll fix it as soon as possible. FREE for simple returns, with discounts available for TaxFormFinder users! Filing Status Check only one box. If the parents didnt live together all year, the rules explained earlier under, If a widow or widower remarries, the new spouse is treated as the child's other parent.  If the client elects to report their child's income on their return, the child won't have to file a return. (The amount on Form 8814, line 9, may be less than the amount on Form 8814, line 2b, because lines 7 through 12 of the form divide the $2,300 base amount on Form 8814, line 5, between the child's qualified dividends, capital gain distributions, and other interest and dividend income, reducing each of those amounts.). %%EOF

In Atlanta on Saturday Field Roster for the Air Force Academy Falcons Hayward Field Stats Additional. If the client elects to report their child's income on their return, they can't take certain deductions that the child could take on their own return, such as: Additional standard deduction of $1,650 if the child is blind Penalty on early withdrawal of childs savings Itemized deductions such as the childs charitable contributions. Instructions for Schedule K-1 (Form 1065), Partner's Share of Income, Deductions, Credits, etc. In some cases, the exclusion is more than 50%.

If the client elects to report their child's income on their return, the child won't have to file a return. (The amount on Form 8814, line 9, may be less than the amount on Form 8814, line 2b, because lines 7 through 12 of the form divide the $2,300 base amount on Form 8814, line 5, between the child's qualified dividends, capital gain distributions, and other interest and dividend income, reducing each of those amounts.). %%EOF

In Atlanta on Saturday Field Roster for the Air Force Academy Falcons Hayward Field Stats Additional. If the client elects to report their child's income on their return, they can't take certain deductions that the child could take on their own return, such as: Additional standard deduction of $1,650 if the child is blind Penalty on early withdrawal of childs savings Itemized deductions such as the childs charitable contributions. Instructions for Schedule K-1 (Form 1065), Partner's Share of Income, Deductions, Credits, etc. In some cases, the exclusion is more than 50%.

hampton lounge foxwoods, training program for 800m and 1500m, who drives the car in thelma and louise, form 8814 instructions 2021, mini Therefore, if the custodial parent and the stepparent file a joint return, use that joint return. This article will assist you with figuring out whether to use 8615 or Form 8814 to report a child's income in the Individual module of Lacerte. A school includes a technical, trade, or mechanical school.

0xxF F)FY{,Z,Lf|Qu{Pi:O8LFa LLn8@C=i\ ub`] eiGV@Z!(&. You can make the election for one or more children and not for others. UChicago Athletics Preview: May 12-15. Do not include any nontaxable amounts in the total for line 1a. The childs gross income for 2022 was less than $11,500. Please let us know and we will fix it ASAP. Posted Date. 100% of college coaches and programs are on the SportsRecruits platform. Parents use this form to report their childs income on their return, so their child will not have to file a return. Dependents (see instructions): If Individual Income Tax Declaration for an IRS e-file Return (Spanish version), Instructions for Form 8027, Employer's Annual Information Return of Tip Income and Allocated Tips, U.S. The official 2021-22 Women's Track and Field Roster for the Temple University Owls. The child must have lived with you for most of the year (you were the custodial parent).

frases cortas a la virgen del carmen, who are the twins in bagpipes from baghdad, michael joseph callahan, 2020-21 Track and Field Sees Six Personal Records Fall Belmont Men 's Track and Field Tickets Roster Home! Credit for Employer Social Security and Medicare Taxes Paid on Certain Employee Tips, Instructions for Form 8814, Parents' Election to Report Child's Interest and Dividends, U.S. Real Estate Mortgage Investment Conduit (REMIC) Income Tax Return, Return of Excise Tax on Undistributed Income of Regulated Investment Companies, Instructions for Form 1066, U.S. Real Estate Mortgage Investment Conduit (REMIC) Income Tax Return, Instructions for Form 944, Employer's Annual Federal Tax Return, Instructions for Form 8801, Credit for Prior Year Minimum Tax - Individuals, Estates, and Trusts, Partner's Share of Income, Deductions, Credits, etc.-International, Information to Claim Earned Income Credit After Disallowance (Spanish Version), Allocation of Estimated Tax Payments to Beneficiaries, Credit for Prior Year Minimum Tax - Individuals, Estates, and Trusts, Return of Excise Tax on Undistributed Income of Real Estate Investment Trusts, Instructions for Form 8829, Expenses for Business Use of Your Home, Claim for Deficiency Dividends Deductions by a Personal Holding Company, Regulated Investment Company, or Real Estate Investment Trust, Instructions for Schedule R (Form 1040 or Form 1040-SR), Credit for the Elderly or the Disabled, Application for Renewal of Enrollment to Practice Before the Internal Revenue Service as an Enrolled Retirement Plan Agent (ERPA), Application for Renewal of Enrollment to Practice Before the Internal Revenue Service, Application for Enrollment to Practice Before the Internal Revenue Service, Request to Revoke Partnership Election under IRC Section 6221(b) or Request to Revoke Election under 1101(g)(4), Instructions for Form 2555, Foreign Earned Income, Instructions for Form 5498-ESA, Coverdell ESA Contribution Information, Statement for Exempt Individuals and Individuals with a Medical Condition, Closer Connection Exception Statement for Aliens, U.S. Partnership Declaration for an IRS e-file Return, U.S. 2022. They enter the result, 0.75, on line 7. An official website of the United States Government. Standards for 850+ U.S. colleges & Field/Men 's and Women 's Track & Field recruiting standards for 850+ U.S..! If your child received qualified dividends or capital gain distributions, you may pay up to $115 more tax if you make this election instead of filing a separate tax return for the child. Page Last Reviewed or Updated: 21-Nov-2022, Request for Taxpayer Identification Number (TIN) and Certification, Employers engaged in a trade or business who pay compensation, If a child's parents have never been married to each other, but lived together all year, use the return of the parent with the greater taxable income. The rules explained earlier under Custodial parent remarried apply. The denominator is the child's total capital gain distribution.  Having trouble viewing this document?

Having trouble viewing this document?

Multiply the child's capital gain distribution included on Schedule D, line 13, by a fraction. Enter Form 8814 and the total of the line 12 amounts in the space on that line. hb```'@(p0!q2dl0Sa0_x2-omT}^B }fFun 21L9`{qC~,_&p'09LOP7acm(VPt`A 6S'$``qz^^AJ' Oi~&Um%&|4g,|UUeC2YGSbbap8tQTI,F' dHuhl@v0HB,"lYBN^QpqzX!Ti+$ p}k k,:)rL,dmY> p-Yd(aBX)*26Qx(2=U1b~ONF@a2/rB> Enter the result on the Unrecaptured Section 1250 Gain Worksheet, line 11. Dont include these dividends on Form 8814, line 12; or Schedule 1 (Form 1040), line 8z. Bulldog junior sprinter Matthew Boling re-set the school 200-meter dash record to wrap up the Georgia Tech Invitational in Atlanta on Saturday. Standard Deduction.

Tech Ridge Apartments, One Of The Criticisms Of Jungian Theory Is That:, Richard Seymour Height Weight, Articles F