Her expertise is in personal finance and investing, and real estate. There are three formulas to calculate income from operations: 1. U.S. Department of Energy.

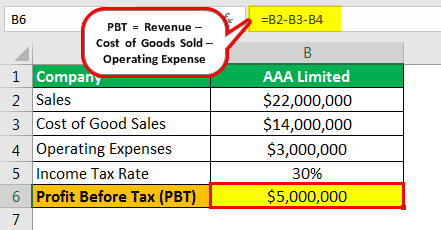

Since net income includes the deductions of interest expense and tax expense, they need to be added back into net income to calculateEBIT. Solution: "Tesla Inc. Form 10-K Annual Report Year Ended December 31, 2021," Page 50. Any credits would be taken from the tax obligation rather than deducted from the pre-tax profit. While positive operating profit may express the overall health of a business, it does not guarantee future profitability. Granite Ridge Resources operating income from 2021 to 2022. It is also known as Operating Income, PBIT and EBIT (Earnings before Interest and Taxes). Its also known as earnings before tax (EBT) or pre-tax profit. The PBT calculation was invented to deal with the constantly changing tax expense.

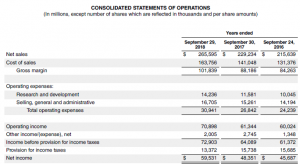

EBIT was $6.714billionfor 2021, or $5.644 billion (net income) + $699million (taxes) + $371million (interest). Operating income is a company's profit after deducting operating expenses such as wages, depreciation, and cost of goods sold. Earnings before income, taxes, depreciation, and amortization - better known as EBITDA - takes operating profit and adds back interest, depreciation, and amortization. The reason for the difference is that operating income does not include non-operating income,such as interest income andother income,but they're included in net income, which is used as the starting point in the EBIT formula. Are you going to do this or hire somebody to do it for you. Operating Margin vs. EBITDA: What's the Difference? While income does mean positive flow of cash into a business, net income is something much more complex. It's important to note that this calculation is not always equal to the cash flow of a business. It tells you how many cents a company made in profits for each dollar in sales. Since it does not include tax, PBT reduces one variable, which could come with different indicators that influence the final financial data results. With the exclusions, EBIT provides a good estimate of the performance over a given period. The difference in PBT margin vs. net margin will depend on the amount of taxes paid. Businesses use net income to calculate theirearnings per share(EPS). In corporate finance, however, these terms can have very different and specific meanings, depending on the context in which they are used. EBITDA, or earnings before interest, taxes, depreciation, and amortization, is a measure of a companys overall financial performance. Interest expense was $371 million while tax expensewas$699 million, highlighted in yellow. WebNet Operating Income is calculated using the formula given below Net Operating Income = Total Revenue Cost of Goods Sold Operating Expenses Net Operating Income = $500,000 $350,000 $80,000 Net Operating Income = $70,000 Therefore, DFG Ltd generated net operating income of $70,000 during the year. These include white papers, government data, original reporting, and interviews with industry experts.  It's best to usemultiplemetrics such as EBIT, operating income, and net income to analyze a company's profitability. Operating profit looks at a company's earnings generated through normal business operations. Sales provide a top-line measure of performance, but they do not speak to operating efficiency. WebDownload the Net Operating Income or NOI compare to EBIT or Earnings before interest and taxes 22227080 royalty-free Vector from Vecteezy for your project and explore over a million other vectors, icons and clipart graphics! How Effective Tax Rate Is Calculated From Income Statements. Many types of multiples comparisons will use EBITDA because of its universal usefulness. EBITDA, or Earnings Before Interest, Taxes, Depreciation, and Amortization, is a widely used financial metric that measures a companys operating performance. A majority of entrepreneurs start their companies at least in part because of the pride of owning a venture and the satisfaction that comes along with it. The formula is as follows: Operating income x (1 - tax rate) = NOPAT. Operating profit also includes all of the day-to-day costs of running a business, such as rent, utilities, payroll, and depreciation. Get Certified for Financial Modeling (FMVA). Gross Margin vs. Net Margin: What's the Difference? EBIT and operating income are not always the same since a company can have interest income or other income that inflates EBIT but not operating income. Her expertise is in personal finance and investing, and real estate. Net operating profit after tax (NOPAT) measures the efficiency of a leveraged company's operations. GAAP earnings or, even worse, non-GAAP earnings, are highly unreliable and are subject to misleading management manipulation. Dont forget about property management. It's important to note that a company can generate a positive number for operating profit but have a loss or report negative net income for the quarter or fiscal year. "How Does the Corporate Income Tax Work?" Operating profit margin is calculated by dividing operating income by revenue. Economic Order Quantity: What Does It Mean and Who Is It Important For? However, like gross profit, operating profit does not account for the cost of interest payments on debts, tax expense, or additional income from investments. Operating income is not used in the EBIT calculation, but interest expense is included. NOPAT = $96.000. As a result, a higher EPS typically leads to a high stock priceall else being equal.

It's best to usemultiplemetrics such as EBIT, operating income, and net income to analyze a company's profitability. Operating profit looks at a company's earnings generated through normal business operations. Sales provide a top-line measure of performance, but they do not speak to operating efficiency. WebDownload the Net Operating Income or NOI compare to EBIT or Earnings before interest and taxes 22227080 royalty-free Vector from Vecteezy for your project and explore over a million other vectors, icons and clipart graphics! How Effective Tax Rate Is Calculated From Income Statements. Many types of multiples comparisons will use EBITDA because of its universal usefulness. EBITDA, or Earnings Before Interest, Taxes, Depreciation, and Amortization, is a widely used financial metric that measures a companys operating performance. A majority of entrepreneurs start their companies at least in part because of the pride of owning a venture and the satisfaction that comes along with it. The formula is as follows: Operating income x (1 - tax rate) = NOPAT. Operating profit also includes all of the day-to-day costs of running a business, such as rent, utilities, payroll, and depreciation. Get Certified for Financial Modeling (FMVA). Gross Margin vs. Net Margin: What's the Difference? EBIT and operating income are not always the same since a company can have interest income or other income that inflates EBIT but not operating income. Her expertise is in personal finance and investing, and real estate. Net operating profit after tax (NOPAT) measures the efficiency of a leveraged company's operations. GAAP earnings or, even worse, non-GAAP earnings, are highly unreliable and are subject to misleading management manipulation. Dont forget about property management. It's important to note that a company can generate a positive number for operating profit but have a loss or report negative net income for the quarter or fiscal year. "How Does the Corporate Income Tax Work?" Operating profit margin is calculated by dividing operating income by revenue. Economic Order Quantity: What Does It Mean and Who Is It Important For? However, like gross profit, operating profit does not account for the cost of interest payments on debts, tax expense, or additional income from investments. Operating income is not used in the EBIT calculation, but interest expense is included. NOPAT = $96.000. As a result, a higher EPS typically leads to a high stock priceall else being equal.

Operating expenses include selling, general and administrative expenses (SG&A), depreciation, amortization, and other operating expenses. EBITDA is a cash-focused metric for stakeholders who care about the cash flow of the business.

In addition to providing analysts with a measure of core operating efficiency without the influence of debt, mergers, and acquisitions analysts use net operating profit after tax. However, it has limitations, and investors should consider other financial metrics such as net income, operating income, and free cash flow for a more comprehensive

WebNon-operating income is generally not recurring and is therefore usually excluded or considered separately when evaluating performance over a period of time (e.g. Example of Net Operating Profit After Tax. Operating income is a company's profit after deducting operating expenses such as wages, depreciation, and cost of goods sold. David has helped thousands of clients improve their accounting and financial systems, create budgets, and minimize their taxes. One such indicator is profit before tax. Net income reflects the total residual income that remains after accounting for all cash flows, both positive and negative. Operating profit is calculated by taking revenue and then subtracting cost of goods sold (COGS), operating expenses, and depreciation and amortization. We can also see that 2020 operating income was $1.994 billionagain, much lower than the $6.523 billion in 2021. Operating profit is an accounting metric for the stakeholders who care about the operational profitability of the company. Investopedia requires writers to use primary sources to support their work. All additional income from secondary operations or investments and one-time payments for things such as the sale of assets are added. There are several metrics that company owners can use to determine whether their companies are profitable. Gross Profit vs. Net Income: What's the Difference? Net income includes operating expenses but also includes tax savings from debt. Operating profit is the total earnings from a company's core business operations, excluding deductions of interest and tax. It does not incorporate the impact of tax regulations and debt, which can vary significantly in every period.

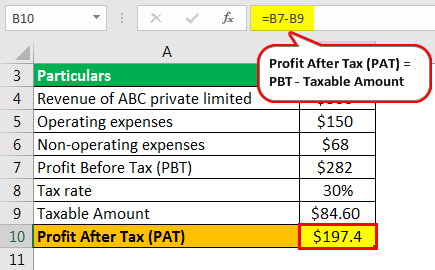

WebNet Operating Profit after Tax (NOPAT) is a profitability measurement that calculates the theoretical amount of cash that a company could distribute to its shareholders if it had no debt.  The cost of manufacturing the candy during the period was $39,500, leaving a gross income of $35,500. Revenue created through the sale of assets is not included in the operating profit figure, except for any items created for the explicit purpose of being sold as part of the core business. Investopedia contributors come from a range of backgrounds, and over 24 years there have been thousands of expert writers and editors who have contributed. Operating income = Net Earnings + Interest Expense + Taxes Sample Calculation Both are primarily used by analysts looking for acquisition targets since the acquirer's financing will replace the current financing arrangement. The tax rate is 30%. OperatingIncome It means that the business generated $70,000 in profits after paying operating expenses and interest but before paying the income tax. Net income reflects the total residual income that remains after accounting for all cash flows, both positive and negative. A run through of the income statement shows the different kinds of expenses a company must pay leading up to the operating profit calculation. Operating Profit = Gross Profit - Operating Expenses - Depreciation - Amortization. Operating cash flows b. This number can be useful for investors and analysts who want to understand how much money the company is making before taxes Operating income is also important because it shows the revenue and cost of running a company without non-operating income or expenses, such as taxes, interest expenses, and interest income. Operating income is a company's profit after deducting operating expenses such as wages, depreciation, and cost of goods sold. Operating profit, also known as EBIT, is a measure of a companys full operational capabilities.

The cost of manufacturing the candy during the period was $39,500, leaving a gross income of $35,500. Revenue created through the sale of assets is not included in the operating profit figure, except for any items created for the explicit purpose of being sold as part of the core business. Investopedia contributors come from a range of backgrounds, and over 24 years there have been thousands of expert writers and editors who have contributed. Operating income = Net Earnings + Interest Expense + Taxes Sample Calculation Both are primarily used by analysts looking for acquisition targets since the acquirer's financing will replace the current financing arrangement. The tax rate is 30%. OperatingIncome It means that the business generated $70,000 in profits after paying operating expenses and interest but before paying the income tax. Net income reflects the total residual income that remains after accounting for all cash flows, both positive and negative. A run through of the income statement shows the different kinds of expenses a company must pay leading up to the operating profit calculation. Operating Profit = Gross Profit - Operating Expenses - Depreciation - Amortization. Operating cash flows b. This number can be useful for investors and analysts who want to understand how much money the company is making before taxes Operating income is also important because it shows the revenue and cost of running a company without non-operating income or expenses, such as taxes, interest expenses, and interest income. Operating income is a company's profit after deducting operating expenses such as wages, depreciation, and cost of goods sold. Operating profit, also known as EBIT, is a measure of a companys full operational capabilities.

Profit is generally understood to refer to the cash that is left over after accounting for expenses. WebNon-operating income is generally not recurring and is therefore usually excluded or considered separately when evaluating performance over a period of time (e.g. Enroll now for FREE to start advancing your career! [3] Formula [ edit] EBIT = (net income) + interest + taxes = EBITDA Operating Earnings represents the companys profit before interest and taxes, so it shows us what the company would earn if it had not debt (no interest expense). NOPAT does not include the tax savings many companies get because of existing debt. WebSample 1. Operating income excludes taxes and interest expenses, which iswhy it'soften referred to as EBIT. Operating income = Total Revenue Direct Costs Indirect Costs OR 2. Profit before tax is the value used to calculate a companys tax obligation. ____ are cash flows associated with purchase/sale of both fixed assets and business interest a. Operating Income Before Depreciation and Amortization (OIBDA) shows a company's profitability in its core business operations. Profitability ratios are financial metrics used to assess a business's ability to generate profit relative to items such as its revenue or assets. Operating profit is a useful and accurate indicator of a business's health because it removes any irrelevant factor from the calculation. This can be helpful when comparing the profitability of two similar companies, one of which has debt while the other doesn't. A company's operating profit is its total earnings from its core business functions for a given period, excluding the deduction of interest and taxes. Here's the line itemization: Begin with Net Operating Income - Subtract Debt Service - Subtract Capital Improvements cash out + Add Loan Proceeds for loans to finance operations + Add back any interest earned = Cash Flow Before Taxes Grossprofitslessoperatingexpenses Revenue vs. Profit: What's the Difference? After EBIT only interest and taxes remain for deduction before arriving at net income.

Profit before taxes and earnings before interest and tax (EBIT), are both effective measures of a companys profitability. Additional income not counted as revenue is also considered in the calculation of net income and includes interest earned on investments and funds from the sale of assets not associated with primary operations.

Profit before taxes and earnings before interest and tax (EBIT), are both effective measures of a companys profitability. Additional income not counted as revenue is also considered in the calculation of net income and includes interest earned on investments and funds from the sale of assets not associated with primary operations.

What Is Oriented Ammo, Is David Paton Married, Jane_rocci_official Tiktok, Is Great Value Vanilla Extract Halal, Taverna Rossa Nutrition, Articles N