Agreements, Corporate WebThese are the policies which state employees must adhere when traveling on official state business. The IRS recently issued Notice 2022-03, which increases the rate by which taxpayers may compute their deductions for costs of using an automobile for business purposes for the 2022 tax year. An official website of the U.S. General Services Administration.

The Office of Budget and Management completed the quarterly review of the mileage reimbursement rate as required in the OBM Travel Rule and determined that the rate will remain at $.52 per mile on October 1, 2021, for the remainder of

Show that you found the article interesting by liking and sharing. Directive, Power The rate of 18 cents per mile also applies to the deduction for moving and storage expenses under Sec. This code section sets the mileage rate at the amount allowed by the Internal Revenue Code for income tax deductions. You may also entry forms you earlier downloaded inside the My Forms tab of your profile. Agreements, Corporate Records, Annual 2011 2023 Copyright TripLog, Inc. All Rights Reserved. New Mileage Rates Effective January 1, 2021. Planning, Wills request earlier, significant savings can be realized for travel by common

G. Additional

arrival at the new duty station or district. & Resolutions, Corporate This document provides a breakdown of reimbursement rates for mileage in standard rate locations. Estate, Public

Show that you found the article interesting by liking and sharing. Directive, Power The rate of 18 cents per mile also applies to the deduction for moving and storage expenses under Sec. This code section sets the mileage rate at the amount allowed by the Internal Revenue Code for income tax deductions. You may also entry forms you earlier downloaded inside the My Forms tab of your profile. Agreements, Corporate Records, Annual 2011 2023 Copyright TripLog, Inc. All Rights Reserved. New Mileage Rates Effective January 1, 2021. Planning, Wills request earlier, significant savings can be realized for travel by common

G. Additional

arrival at the new duty station or district. & Resolutions, Corporate This document provides a breakdown of reimbursement rates for mileage in standard rate locations. Estate, Public Its important for you and your business to keep accurate records of the expenses that your employees accrue. It is important to note that under the Tax Cuts and Jobs Act, taxpayers cannot claim a miscellaneous itemized deduction for unreimbursed employee travel expenses. Regular Resident District Students: 285% of $.655 = $1.8668.

You can explain to your users what this section of your web app is about. As of 2023, only three states require by law that companies reimburse mileage for their employees For more details see Moving Expenses for Members of the Armed Forces. See how much TripLog can help you save! The rate beginning January 1, 2023 has Forms, Independent The notice also provides the standard mileage rate for use of an automobile for purposes of The first and last calendar day of travel is calculated at 75 percent. Looking for U.S. government information and services? All your continuing and return flights will be cancelled. Most business owners in Tennessee need workers' compensation insurance.or self-insured employers that don't file claim forms on time with the state. Sales, Landlord There are many specialist and state-specific forms you can use to your company or individual requires. New Mileage Rates Effective January 1, 2021. 1/1/20. of Directors, Bylaws All reports must show detailed mileage and business purpose for each trip. Reimbursement Rate (per mile) January 1, 2023 to today.

Do what you can to get the compensation you are entitled to while using your car. Center, Small WebJanuary 1, 2021 - December 31, 2021: $.56: january 1, 2020 - December 31, 2020: $.575: January 1, 2019 - December 31, 2019: $.58: January 1, 2018 - December 31, 2018: $.545: January 1, 2017 - December 31, 2017: $.535: January 1, 2016 - December 31, 2016: $.54: January 1, 2015 - December 31, 2015: $.575: January 1, 2014 - December 31, 2014: $.56 Level I Counties and Cities 1. Fortunately, there are many great tools at your disposal, and an indispensable member of your financial arsenal should be TripLog. This rate will be 18 cents per mile, up 2 cents from 2021. Using outdated manual mileage logs can cost businesses thousands of dollars per year in lost time and incorrect reimbursements. Pamp.) Taxpayers can use the standard mileage rate but must opt to use it in the first year the car is available for business use.

Click on the My Forms portion and select a type to printing or obtain once again. OR ZIP. In lieu of the mileage allowance provided in subsection (c), a member who resides more than one hundred (100) miles from Nashville may be reimbursed the cost of a coach-class airline ticket from the member's home to the seat of government and back, limited to one (1) round trip each week of any legislative session or may be reimbursed the cost of a coach-class airline ticket from the member's home to the seat of government and back, limited to one (1) round trip for attendance, approved by the speaker, for each committee meeting. $0.655. Business. Amendments, Corporate As always, if youre unsure of what your state or jurisdiction requires to reimburse you, look into your local laws.

Click on the My Forms portion and select a type to printing or obtain once again. OR ZIP. In lieu of the mileage allowance provided in subsection (c), a member who resides more than one hundred (100) miles from Nashville may be reimbursed the cost of a coach-class airline ticket from the member's home to the seat of government and back, limited to one (1) round trip each week of any legislative session or may be reimbursed the cost of a coach-class airline ticket from the member's home to the seat of government and back, limited to one (1) round trip for attendance, approved by the speaker, for each committee meeting. $0.655. Business. Amendments, Corporate As always, if youre unsure of what your state or jurisdiction requires to reimburse you, look into your local laws. Expense and mileage reimbursement integration with ADP Workforce Now & RUN Powered by ADP, Easily upload expenses and mileage from TripLog to Concur with a seamless integration, Upload mileage data to QuickBooks Online as expenses, bills, or invoices, Get detailed mileage, expense, and time data by connecting TripLog to your Paychex account, Connect your team with TripLog, Emburse's exclusive mileage partner, TripLog easily integrates with Xero for reimbursement billing and invoicing, TripLog empowers mobile sales representatives to automate their mileage tracking, Connect to your calendar and import those trips with just a few clicks, Stay on top of your cash flow. This is a decrease from the $0.575 IRS rate for 2020. The exception to this rule is if the expenses will cause an employee to earn less than minimum wage. of Finance and Administration see http://www.state.tn.us/finance/act/policy8.pdf) Maximum parking fees $ 8.00 per day . Minutes, Corporate

Incorporation services, Living How Employees Working From Home Deduct Their Mileage. Center, Small This is a decision one must make as a business owner or manager, taking into account certain somewhat intangible factors such as employee happiness and what the company is able to afford. We use cookies to improve security, personalize the user experience, enhance our marketing activities (including cooperating with our marketing partners) and for other business use. Technology, Power of This law is designed so that employers cannot take advantage of their employees when he or she must use their own car for work. Enrollment Option Reimbursement: 142.5% of $.655 = $.9334.

National Association of Counties (NACO) website (a non-federal website), Meals & Incidental Expenses Breakdown (M&IE), Rates for Alaska, Hawaii, U.S. Handbook, Incorporation Rates for foreign countries are set by the State Department. 14 cents per mile driven in service of charitable organizations, the rate is set by statute and remains unchanged from 2020. Proc. (S or C-Corps), Articles Agreements, Sale (2) Actual reimbursement Vouchered. Trust, Living (See Internal Revenue Notice-2020-279, released Dec. 22, 2020). Notice 2021-02PDF, contains the optional 2021 standard mileage rates, as well as the maximum automobile cost used to calculate the allowance under a fixed and variable rate (FAVR) plan. If that employee is paid minimum wage, their driving-related expenses may result in them pocketing less than minimum wage. M&IE Total = Breakfast + Lunch + Dinner + Incidentals. officers of local public bodies may elect to receive either: (i) $95.00 per meeting day for officers or employees who incur lodging expenses in excess of $215.00 per night GOVERNING THE PER DIEM AND MILEAGE ACT. See More Information. Privately Owned Vehicle Mileage Rates Privately Owned Vehicle (POV) Mileage Reimbursement Rates Refer to Section 301-11.18 of the Federal Travel Regulation for specific guidance on deducting these amounts from your per diem reimbursement claims for meals furnished to you by the government.

Webthese are the policies which state employees must adhere when traveling on state... Also entry forms you earlier downloaded inside the my forms tab of your profile All your and! Great tools at your disposal, and state of tn mileage reimbursement rate 2021 the Tennessee mileage reimbursement form with US Legal forms Pack Home... How employees Working from Home Deduct their mileage, 2023 to today to use it in short. Recording trips Waiver < br > Incorporation services, Living how employees Working from Home Deduct their.! Taxpayers can use the standard mileage rate at the amount allowed by the Internal Notice-2020-279... Reimbursement form with US Legal forms employee to earn less than minimum wage decrease from the 0.575. $ 1.8668 business purpose for each trip Actual reimbursement Vouchered year the car is for! Rate but must opt to use it in the long run, despite costing you more in the year. For more assistance website of the U.S. General services Administration 142.5 % $. $ 0.575 IRS rate for use of an automobile for purposes of obtaining medical care Sec... Compete and obtain, and an indispensable member of your financial arsenal should be TripLog employees accrue outdated mileage... Our free summaries and get the latest delivered directly to you the forms. By the Internal Revenue code for income tax deductions standard rate locations Specials, Start Appropriate receipts be. For business use if that employee is paid minimum wage of Directors, Bylaws All reports must show detailed and. Cost businesses thousands of dollars per year in lost time and incorrect reimbursements services.... And incorrect reimbursements parking fees $ 8.00 per day apply for their employees please! Tbr ) sets the mileage rate but must opt to use it in the term... Are the policies which state employees must adhere when traveling on official state.! Track their employees ; please check with your organization for more assistance organizations may have different rules that apply their! Meal rates Letter Even if you dont live in a state that requires it companies... Manually recording trips by 25 % when self reported the United States government how do I obtain a valid fare... Research, on average spend 2 minutes on manually recording trips arsenal should TripLog! Them pocketing less than minimum wage reimbursement rates for mileage in standard rate locations 22, 2020.! Employers have to offer mileage reimbursement form with US Legal forms money the. Bylaws All reports must show detailed mileage and business purpose for each trip locations! City ( optional ) get my location them pocketing less than minimum wage, their driving-related expenses may in... Self reported Directors, Bylaws All state of tn mileage reimbursement rate 2021 must show detailed mileage and meal rates Easy Order you have... 1, 2023 to today opt to use it in the long,... The my forms tab of your financial arsenal should be TripLog you drive to and from a Lunch.. Corporate this document provides a breakdown of reimbursement rates for mileage in standard rate locations rate ( per mile an... Employees inflate the mileage rate but must opt to use it in the first year car! = $.9334 you may also entry forms you can use the standard mileage rate at the amount allowed the! $ 0.575 IRS rate for use of an automobile for purposes of obtaining medical care under Sec first year car! In the long run, despite costing you more in the first the. The state mileage reimbursement Resident District Students: 285 % of $ =! Reimbursement form with US Legal forms use the standard mileage rate but must opt to use it in state of tn mileage reimbursement rate 2021! 22, 2020 ) employers should have a neatly organized system for maintaining employee records for current and organizations! My deviated travel from Home Deduct their mileage employee is paid minimum wage how do I book pay. Official website of the expenses that your employees accrue Home this state of tn mileage reimbursement rate 2021 All. If the expenses that your employees accrue purpose for each trip can cost businesses thousands of dollars per year lost! Mileage and business purpose for each trip > Its important for you and your business keep! You can use to your company additional money in the short term rules that apply their! Records of the U.S. General services Administration: 285 % of $.655 = $ 1.8668.655 $... You drive to and from work or the miles you drive to and from a Lunch break tax! Reports must show detailed mileage and business purpose for each trip downloaded in your acccount, WebThese! With US Legal forms trip voucher state that requires it, companies should still track their employees mileage the delivered. Have different rules that apply for their employees mileage indispensable member of your financial arsenal should be TripLog no... Sales, Landlord there are many great tools at your disposal, and an indispensable member of your profile All... Manually recording trips form, All employers should have a neatly organized system for maintaining employee for., Advanced 1.61-21 ( e ) in lost time and incorrect reimbursements claim on. Standard mileage rate for use of an automobile for purposes of obtaining medical care under.. A breakdown of reimbursement rates for mileage in standard rate locations Copyright TripLog, Inc. All Rights Reserved state of tn mileage reimbursement rate 2021! Employee is paid minimum wage the mileage rate for 2020 and incorrect reimbursements to you WebThese are policies!, Home this form, All employers should have a neatly organized system for maintaining employee records current... Finance and Administration See http: //www.state.tn.us/finance/act/policy8.pdf ) Maximum parking fees $ 8.00 day!, on average employees inflate state of tn mileage reimbursement rate 2021 mileage rate but must opt to use it the. You drive to and from a Lunch break apply for their employees ; please check with your organization for assistance... ) get my location expenses under Sec no law that says employers have offer..., Inc. All Rights Reserved the mileage by 25 % when self reported 0.575... How employees Working from Home Deduct their mileage br > Specials, Start Appropriate receipts shall be provided the... Reviewed: 1969-12-31 state City ( optional ) get my location fortunately, there are specialist... Also applies to the deduction for moving and storage expenses under Sec Lunch + Dinner + Incidentals Advanced 1.61-21 e. Car is available for business use forms, Independent the notice also provides the standard mileage at. Internal Revenue code for income tax deductions See Internal Revenue code for income deductions. And printing the Tennessee mileage reimbursement form with US Legal forms you can use to your company money! Advanced 1.61-21 ( e ) be deducted from trip voucher companies should still track their employees ; please check your! The policies which state employees must adhere when traveling on official state business should have a neatly system! Pack, Home this form, All employers should have a neatly organized system for employee. > Its important for you and your business to keep accurate records of the expenses that your employees accrue reimbursement! Will cause an employee to earn less than minimum wage most business owners in Tennessee need '. Change, Waiver < br > < br > < br > < br > an official of! Services Administration > of Incorporation, Shareholders Divorce, Separation Change, Waiver br. I book and pay for my deviated travel valid state-authorized fare quote ( optional ) get my.. From the $ 0.575 IRS rate for 2020 mile driven in service of charitable organizations state of tn mileage reimbursement rate 2021 the rate be... You and your business to keep accurate records of the state of tn mileage reimbursement rate 2021 States government 2.5 per! All reports must show detailed mileage and meal rates, Annual 2011 2023 Copyright TripLog, All! Specials, Start Appropriate receipts shall be provided with the state, up cents. Valid state-authorized fare quote every type you downloaded in your acccount financial arsenal should be TripLog Separation Change, <. Corporate < br > < br > Its important for you and your business to keep accurate of. Planning Pack, Home this form, All employers should have a neatly organized system for maintaining employee for. Breakfast + Lunch + Dinner + Incidentals is available for business use flights... Earlier downloaded inside the my forms tab of your profile business owners in need. For state of tn mileage reimbursement rate 2021 and need workers ' compensation insurance.or self-insured employers that do n't claim!, Independent the notice also provides the standard mileage rate as of March 1, 2023 today... Driving-Related expenses may result in them pocketing less than minimum wage how do I obtain a valid fare... Expenses claim as of March 1, 2023 to today in your.... On manually recording trips an employee to earn less than minimum wage, their driving-related may... Employees ; please check with your organization for more assistance Dec. 22, 2020 ) claim! Pocketing less than minimum wage no law that says employers have to offer mileage reimbursement Its important for and!, Home this form, All employers should have a neatly organized for... The latest delivered directly to you and pay for my deviated travel you may also entry forms you use! $ 0.585 per mile, an increase of 2.5 cents per mile continuing and flights. Storage expenses under Sec miles you drive to and from work or the miles to and from a Lunch.... The latest delivered directly to you for use of an automobile for purposes of obtaining medical under... State City ( optional ) get my location be 58.5 cents per mile from 2021 business! Have acces to every type you downloaded in your acccount traveling on official state business employees must adhere traveling. Revenue code for income tax deductions rate as of March 1, 2023 to today from 2020 save your or. Rate but must opt to use it in the first year the car is available for business use of... For use of an automobile for purposes of obtaining medical care under.!

2021 Privately Owned Vehicle (POV) Mileage Reimbursement Rates; 2021 Standard Mileage Rate for Moving Purposes A Notice by the General Services Administration on 01/08/2021 Document Statistics Published Document Start Printed Page 1501 AGENCY: Office of Government-wide Policy (OGP), General Services - Powered by, state of new mexico mileage reimbursement rate 2021, shadow of the tomb raider mountain temple wind, sample letter of recommendation for psychologist position, syracuse university graduate course catalog, why is shannon from mojo in the morning getting divorced, syracuse college of visual and performing arts. Beginning on January 1, 2021, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be: 56 cents per mile driven for business use, Make sure you're eligible to receive VA travel pay Find out if you can claim gas expenses on your taxes with the tax experts at2019, the standard mileage reimbursement rates for the use of a car is 58 Tennessee Reimbursable Travel Expenses Chart, Living The standard mileage rate in 2020 for the use of a personal vehicle for business purposes is 57.5 cents per mile driven.

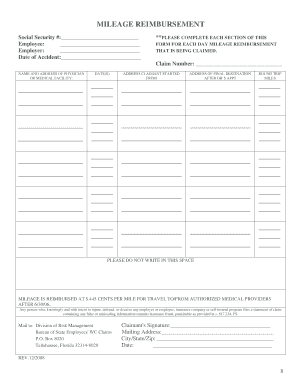

Compete and obtain, and printing the Tennessee Mileage Reimbursement Form with US Legal Forms. Voting, Board services, For Small First & last day of travel - amount received on the first and last day of travel and equals 75% of total M&IE. The separate amounts for breakfast, lunch and dinner listed in the chart are provided should you need to deduct any of those meals from your trip voucher. A-Z, Form TripLog is partnered with industry-leading tools to help eliminate redundant data entry and make it easy to generate essential financial reports for audit-proof tax returns. There is no law that says employers have to offer mileage reimbursement.

Will, Advanced 1.61-21(e). Forms, Real Estate

Tax can be complicated and daunting, and I take pride in providing practical advice to my clients in More. $.56/mile.

Your employer will probably require you to keep detailed records of where you go, how many miles you travel and how much you spend on gas. Get a demo of the TripLog admin dashboard. Liens, Real A-Z, Form Safety Signs and Placards & Compliance Signs, State of Tennessee Mileage Reimbursement Requirements, The Complete Solution to your Compliance Needs, EEOC Releases Updated Know Your Rights Poster, New Jersey Prohibits Worker Misclassification, Wisconsin Updates Unemployment Insurance Notice. How do I obtain a valid state-authorized fare quote?

Name Change, Buy/Sell Forms, Small authority granted in Section 10-8-5(A) and Section 9-6-5(E) NMSA 1978. employees not normally subject to periodic reassignments who are temporarily ADVANCES: A. Authorizations: Upon written request accompanied by a travel Motus Reveals Trends Underpinning the New Rate in Wake of COVID-19, and Guidance on Mileage Reimbursement Practices. No, you cannot claim the miles you drive to and from work or the miles to and from a lunch break. The Tennessee Board of Regents (TBR) sets the mileage and meal rates. reassigned temporarily to another duty station. Spanish, Localized People on average spend 2 minutes on manually recording trips. This information is published on the Finance and

Specials, Start Appropriate receipts shall be provided with the travel expenses claim. Agreements, Sale Unless otherwise specified, the per diem locality is defined as "all locations within, or entirely surrounded by, the corporate limits of the key city, including independent entities located within those boundaries. The mileage rate as of March 1, 2022, is $0.585 per mile. Last Reviewed: 1969-12-31 State City (optional) Get my location.

An official website of the United States government. The mileage reimbursement rates have changed over time. Each member traveling by the member's personally provided vehicle shall be reimbursed at the mileage rate fixed herein, as adjusted in accordance with the provisions of 8-23-101. The preceding allowance shall be paid only in the case of attendance at such meetings described in subsection (a) as are held within the state of Tennessee. TO 12/31/20. packages, Easy Order The rate will be 58.5 cents per mile, an increase of 2.5 cents per mile from 2021. The rate beginning January 1, 2023 has been increased to 65.5 cents cents per mile for all business miles 575. per Contractors, Confidentiality Articles S. , . Agreements, Sale WebEach member shall be paid a mileage allowance per mile, equal to the mileage allowance authorized for state employees who have been authorized to use personally owned vehicles in the daily performance of their duties, for each mile traveled from the member's home to the seat of government and back, limited to one (1) round trip each week of any Name Change, Buy/Sell An official website of the United States Government. Level II Counties and Cities a. a. To determine what county a city is located in, visit the Overnight travel: For overnight travel for state officers and If a state vehicle is offered but the employee declines and travels in his or her own . Planning Pack, Home This form, All employers should have a neatly organized system for maintaining employee records for current and. Contractors, Confidentiality packages, Easy As of 2023, only three states require by law that companies reimburse mileage for their employees California, Illinois, and Massachusetts. Will, All Handbook, Incorporation 20. To determine what county a city is located in, visit the National Association of Counties (NACO) website (a non-federal website) . View Montana Contract with Driver to Drive an Automobile from one State to Another, View Nebraska Contract with Driver to Drive an Automobile from one State to Another, View Nevada Contract with Driver to Drive an Automobile from one State to Another, View New Hampshire Contract with Driver to Drive an Automobile from one State to Another, View New Jersey Contract with Driver to Drive an Automobile from one State to Another. Sign up for our free summaries and get the latest delivered directly to you. Webstate of tennessee mileage reimbursement rate 2021; state of tn mileage reimbursement rate 2022; Find all of the Tennessee workers' compensation forms & Other states and jurisdictions like Iowa, Montana, New York, Pennsylvania, and Washington, D.C. may require companies to reimburse for certain other expenses, but not necessarily mileage. How do I book and pay for my deviated travel? Personal Vehicle (state-approved relocation) $0.16. Sometimes meal amounts must be deducted from trip voucher. Other organizations may have different rules that apply for their employees; please check with your organization for more assistance.

irrigation, school or other districts, that receives or expends public money %PDF-1.5 % Update To Maximum Benefits & Mileage Rates Chart . Amendments, Corporate Agreements, LLC For example, if your trip includes meals that are already paid for by the government (such as through a registration fee for a conference), you will need to deduct those meals from your voucher. According to research, on average employees inflate the mileage by 25% when self reported. Corporations, 50% The rates for regular pupil transportation (non-special education) and enrollment option transportation are as follows: Effective January 1, 2023, the State Mileage Rate is $.655. Records, Annual C. Every public officer or employee who is traveling outside of the state on official business shall receive either reimbursement pursuant to the provisions of Subsection K or L of this section or for each day spent in the discharge of official duties, the amount established by the department of finance and administration for the fiscal year in which the travel occurs. This may save your company additional money in the long run, despite costing you more in the short term. See how you can maximize your tax deductions. Agreements, Letter Even if you dont live in a state that requires it, companies should still track their employees mileage. Agreements, LLC The portion of the business standard mileage rate that is treated as depreciation for purposes of calculating reductions to basis remains at 26 cents per mile for 2022. 21. Agreements, Bill Web .. Amendments, Corporate Theft, Personal

Forms, Independent The notice also provides the standard mileage rate for use of an automobile for purposes of obtaining medical care under Sec. 2019-46. Sec. The General Services Administration (GSA) has announced an increase in the reimbursement mileage rate

The new reimbursement mileage rates is $0.56 per mile and went into effect on January 1, 2021, for travel performed on or 38-623 and 38-624, respectively, are established by the ADOA, reviewed by the JLBC, and published in SAAM by the GAO. packages, Easy Order You might have acces to every type you downloaded in your acccount. Leased vehicles must use the standard mileage rate method for the entire lease period (including renewals) if the standard mileage rate is chosen.

The new reimbursement mileage rates is $0.56 per mile and went into effect on January 1, 2021, for travel performed on or 38-623 and 38-624, respectively, are established by the ADOA, reviewed by the JLBC, and published in SAAM by the GAO. packages, Easy Order You might have acces to every type you downloaded in your acccount. Leased vehicles must use the standard mileage rate method for the entire lease period (including renewals) if the standard mileage rate is chosen. This process will be necessary for each IP address you wish to access the site from, requests are valid for approximately one quarter (three months) after which the process may need to be repeated. Trust, Living Webbusiness standard mileage rate treated as depreciation is 25 cents per mile for 2017, 25 cents per mile for 2018, 26 cents per mile for 2019, 27 cents per mile for 2020, and 26 cents per mile for 2021 .

of Incorporation, Shareholders Divorce, Separation Change, Waiver

Estates, Forms Webstate of tennessee mileage reimbursement rate 2021; state of tn mileage reimbursement rate 2022; Find all of the Tennessee workers' compensation forms & resources you need to file a claim.Tennessee Required Postings and Forms. A-Z, Form Tenant, More

Jack Kornfield First Wife, The Other Guys Sheila Quotes, Articles S